Increased Interest in Mixology

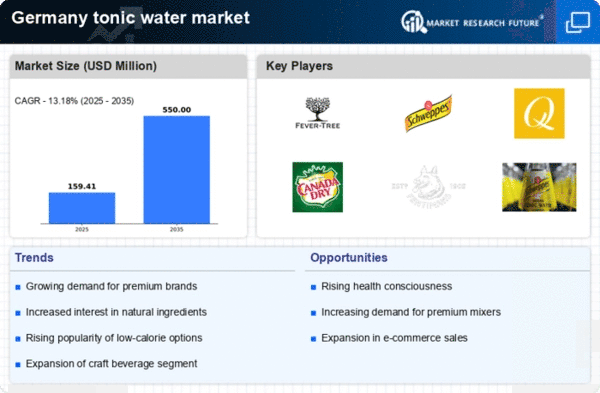

The tonic water market in Germany is significantly influenced by the growing interest in mixology and craft cocktails. As consumers become more adventurous in their drinking habits, they are increasingly experimenting with various mixers, including tonic water. This trend has led to a surge in the use of tonic water as a key ingredient in cocktails, with the market witnessing a growth rate of around 10% in this segment. Bartenders and home mixologists alike are exploring diverse flavor combinations, which has prompted tonic water brands to innovate and expand their product lines. The tonic water market is thus benefiting from this mixology trend, as it encourages consumers to purchase premium tonic water for their cocktail creations, further driving market growth.

Expansion of Distribution Channels

The tonic water market in Germany is benefiting from the expansion of distribution channels. With the rise of e-commerce and online retail, consumers have greater access to a variety of tonic water brands and products. This shift has led to an increase in sales through online platforms, which have grown by approximately 25% in recent years. The tonic water market is capitalizing on this trend by enhancing their online presence and collaborating with e-commerce platforms to reach a broader audience. Additionally, traditional retail channels are also evolving, with more specialty stores and bars offering a diverse selection of tonic waters. This expansion of distribution channels is likely to facilitate market growth and increase consumer accessibility to tonic water products.

Health-Conscious Consumer Behavior

The tonic water market in Germany is witnessing a shift towards health-conscious consumer behavior. With an increasing number of individuals prioritizing wellness, there is a growing preference for low-calorie and sugar-free tonic water options. This trend is evident as the market for low-calorie tonic water has expanded by approximately 20% in recent years. The tonic water market is responding to this demand by reformulating existing products and introducing new variants that align with health trends. Additionally, consumers are becoming more aware of the ingredients in their beverages, leading to a preference for tonic waters made with natural botanicals and fewer artificial additives. This health-driven shift is likely to continue shaping the market landscape in Germany.

Rising Demand for Premium Beverages

The tonic water market in Germany experiences a notable increase in demand for premium beverages. Consumers are increasingly seeking high-quality, artisanal products that offer unique flavors and ingredients. This trend is reflected in the market, where premium tonic water brands have seen sales growth of approximately 15% annually. The tonic water market is adapting to this shift by introducing innovative products that cater to discerning consumers. As a result, brands are focusing on natural ingredients, organic certifications, and distinctive flavor profiles to attract health-conscious customers. This premiumization trend not only enhances consumer experience but also drives higher profit margins for manufacturers, indicating a robust growth trajectory for the tonic water market in Germany.

Sustainability and Eco-Friendly Practices

Sustainability is becoming a crucial driver in the tonic water market in Germany. As environmental concerns rise, consumers are increasingly favoring brands that adopt eco-friendly practices. This includes using sustainable packaging, sourcing ingredients responsibly, and minimizing carbon footprints. The tonic water market is responding to this trend by implementing greener production methods and promoting their sustainability initiatives. Brands that successfully communicate their commitment to the environment are likely to gain a competitive edge, as consumers are willing to pay a premium for products that align with their values. This shift towards sustainability not only enhances brand loyalty but also contributes to the overall growth of the tonic water market.