Growing Consumer Electronics Market

The consumer electronics sector in Germany is a significant driver for the lithium ion-battery market. With the proliferation of smartphones, laptops, and wearable devices, the demand for high-performance batteries is escalating. In 2025, the consumer electronics market is expected to reach €30 billion, with a substantial portion attributed to battery-powered devices. This growth is likely to stimulate advancements in battery technology, as manufacturers strive to meet consumer expectations for longer battery life and faster charging times. The lithium ion-battery market is thus positioned to thrive, as it supplies the necessary power sources for this expanding industry. The interplay between consumer demand and battery innovation indicates a vibrant future for the market.

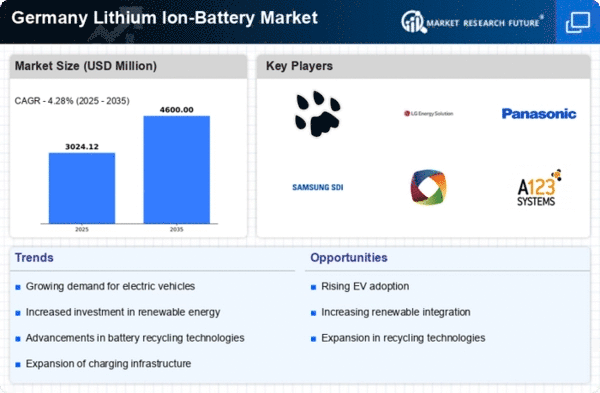

Expansion of Charging Infrastructure

The expansion of charging infrastructure across Germany is a crucial driver for the lithium ion-battery market. As electric vehicle adoption increases, the need for accessible and efficient charging solutions becomes paramount. By 2025, the government plans to install over 1 million charging points nationwide, significantly enhancing the convenience of electric vehicle ownership. This infrastructure development is likely to stimulate demand for lithium ion batteries, as consumers gain confidence in the availability of charging options. Furthermore, the integration of fast-charging technology could potentially reduce charging times, making electric vehicles more appealing. The growth of charging infrastructure thus represents a vital component in the overall expansion of the lithium ion-battery market.

Increasing Investment in Renewable Energy

Germany's commitment to renewable energy sources is significantly impacting the lithium ion-battery market. The transition towards solar and wind energy necessitates efficient energy storage solutions, which lithium ion batteries provide. As of 2025, the country aims to achieve 65% of its energy from renewables, creating a substantial demand for energy storage systems. This shift is likely to drive investments in battery technology, as companies seek to develop more efficient and cost-effective solutions. The lithium ion-battery market is poised to benefit from this trend, as energy storage becomes critical for balancing supply and demand in an increasingly renewable energy landscape. The synergy between renewable energy and battery technology suggests a promising trajectory for the market.

Regulatory Framework and Environmental Standards

The regulatory landscape in Germany is increasingly favoring the lithium ion-battery market through stringent environmental standards and policies. The government has implemented regulations aimed at reducing carbon emissions, which encourages the adoption of electric vehicles and energy storage solutions. As of 2025, compliance with these regulations is expected to drive the market's growth, as manufacturers align their products with environmental standards. Additionally, initiatives promoting recycling and responsible disposal of batteries are likely to enhance the sustainability of the lithium ion-battery market. This regulatory support not only fosters innovation but also positions the market as a key player in Germany's transition towards a greener economy.

Technological Advancements in Battery Production

The lithium ion-battery market is experiencing a surge in technological advancements that enhance battery efficiency and reduce production costs. Innovations such as solid-state batteries and improved lithium extraction methods are being developed, which could potentially increase energy density and lifespan. As of 2025, the market is projected to grow at a CAGR of approximately 15%, driven by these advancements. Furthermore, the integration of automation and AI in manufacturing processes is likely to streamline production, thereby reducing waste and improving overall sustainability. This technological evolution not only supports the automotive sector but also expands applications in consumer electronics and renewable energy storage, indicating a robust future for the lithium ion-battery market.