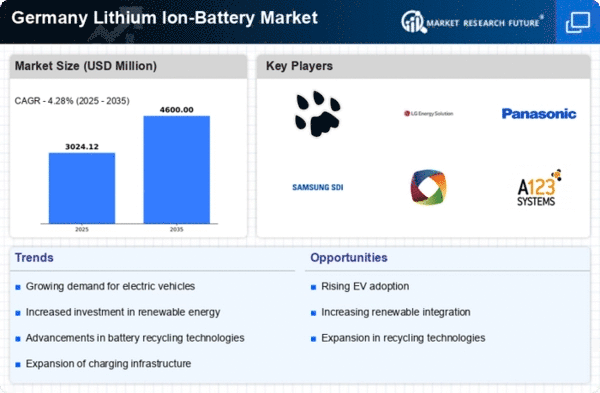

Top Industry Leaders in the Germany lithium ion battery market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Germany lithium-ion battery industry are:

A123 Systems LLC, AT and T Inc., BAK Power, BYD Co. Ltd., Clarios, Envision Group, Exide Industries Ltd., GS Yuasa Corp., Hitachi Ltd., Johnson Controls International Plc, LG Chem, Manz AG, Panasonic Holdings Corp., Samsung SDI Co. Ltd., SK Inc., Sony Group Corp., TDK Corp., Tianjin Lishen Battery Joint Stock Co. Ltd., Toshiba Corp., and Tesla Inc.

The German lithium-ion battery market is a dynamic arena buzzing with both established players and ambitious newcomers. Driven by the country's ambitious electrification goals and surging demand for electric vehicles (EVs) and renewable energy storage, the market offering fertile ground for strategic competition.

Key Players & Strategies:

o BASF: Leading with a focus on high-performance cathode materials and partnerships with automakers like BMW.

o Volkswagen Group: Investing heavily in cell production through PowerCo, targeting cost efficiency and closed-loop recycling.

o Samsung SDI: Leveraging its global footprint and expertise to cater to the growing demand for automotive batteries.

o TerraE: A joint venture between Daimler and Freudenberg, aiming to become a leading European battery cell manufacturer.

o VARTA: Focusing on stationary energy storage solutions and niche applications like medical devices and power tools.

o Northvolt: A Swedish player expanding into Germany, attracting attention with its focus on sustainability and ethical sourcing.

Market Share Analysis:

Analyzing market share in the German lithium-ion battery market involves several critical factors:

- Application Segment: The EV segment currently dominates, but stationary storage and consumer electronics hold significant potential.

- Technology & Differentiation: Players offering high-performance, environmentally friendly, or cost-effective solutions gain an edge.

- Vertical Integration: Controlling the supply chain, from raw materials to cell production, provides cost advantages.

- Government Support: Access to subsidies and research grants can significantly impact market share.

New & Emerging Trends:

- Solid-State Batteries: Offering higher energy density and safety, these batteries are attracting major investments for future applications.

- Second-Life Batteries: Repurposing used batteries for stationary storage creates revenue streams and promotes sustainability.

- Recycling & Circular Economy: Efficient recycling of critical materials like lithium and cobalt is crucial for long-term growth.

- Digitalization & AI: Integrating AI into battery design and production optimizes performance and reduces costs.

Overall Competitive Scenario:

The German lithium-ion battery market is characterized by:

- Intense Competition: Established players vie with startups and foreign entrants for market share.

- Collaboration & Partnerships: Alliances are formed across the value chain to leverage expertise and resources.

- Focus on Innovation: Continuous research and development are crucial for maintaining a competitive edge.

- Sustainability & Regulatory Pressures: Environmental considerations and stringent regulations are shaping market dynamics.

the German lithium-ion battery market is a fiercely competitive space with immense growth potential. Players who adapt to evolving trends, prioritize sustainability, and offer innovative solutions are well-positioned to capitalize on this burgeoning market. With the right strategies and continued investments, Germany can secure a vital role in the global shift towards clean energy technologies.

Latest Company Updates:

- VULCAN ENERGY RESOURCES: Received positive city council vote for its Zero Carbon Lithium™ Project in December 2023, paving the way for geothermal lithium extraction and battery chemicals production. (Source: Vulcan Energy Resources website)

- LG Chem: Partnering with Volkswagen to build a battery cell factory in Germany. (Source: Bloomberg, December 2023)

- Manz AG: Supplying production equipment to several lithium-ion battery manufacturers in Germany. (Source: Manz AG website)

- Tesla Inc.: Building a gigafactory near Berlin, expected to start production in 2024. (Source: Tesla website)