Rising Cybersecurity Threats

The intrusion detection-system market is experiencing growth due to the increasing frequency and sophistication of cyber threats in Germany. Organizations are compelled to invest in advanced security measures to protect sensitive data and maintain operational integrity. In 2025, it is estimated that cybercrime could cost businesses in Germany over €200 billion annually, highlighting the urgent need for effective intrusion detection systems. As companies face potential financial losses and reputational damage, the demand for robust intrusion detection solutions is likely to rise. This trend indicates a proactive approach to cybersecurity, where businesses prioritize the implementation of advanced technologies to mitigate risks associated with cyber threats.

Growing Awareness of Data Privacy

The market is increasingly shaped by the growing awareness of data privacy among consumers and businesses in Germany. With the implementation of stringent data protection regulations, organizations are under pressure to ensure compliance and protect sensitive information. In 2025, it is expected that the demand for intrusion detection systems will rise as companies strive to meet regulatory requirements and avoid hefty fines. This heightened awareness of data privacy issues is prompting businesses to invest in advanced security solutions that can effectively monitor and respond to potential threats. As a result, the intrusion detection-system market is likely to see significant growth driven by the need for enhanced data protection measures.

Expansion of Remote Work Practices

The intrusion detection-system market is experiencing a shift due to the expansion of remote work practices in Germany. As more organizations adopt flexible work arrangements, the attack surface for cyber threats has broadened, necessitating robust security measures. In 2025, it is projected that remote work will account for 30% of the workforce in Germany, leading to increased demand for intrusion detection systems that can secure remote access points. This trend indicates that businesses are recognizing the need to protect their networks from vulnerabilities associated with remote work. Consequently, the intrusion detection-system market is likely to grow as organizations seek to implement effective solutions to safeguard their digital environments.

Increased Investment in IT Infrastructure

The intrusion detection-system market is benefiting from increased investment in IT infrastructure across Germany. As businesses modernize their IT environments, the need for comprehensive security solutions becomes paramount. In 2025, it is anticipated that IT spending in Germany will reach €100 billion, with a significant portion allocated to cybersecurity measures. This investment trend indicates a growing recognition of the importance of safeguarding digital assets. Consequently, organizations are more inclined to adopt intrusion detection systems as part of their overall security strategy. This shift towards enhanced IT infrastructure is likely to bolster the intrusion detection-system market, as companies seek to protect their networks from potential breaches.

Technological Advancements in Security Solutions

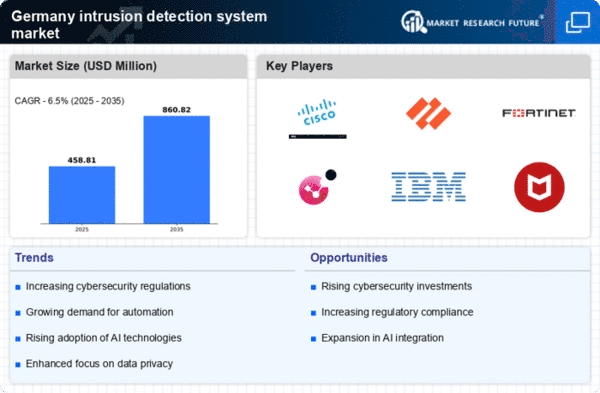

The intrusion detection-system market is significantly influenced by rapid technological advancements in security solutions. Innovations such as real-time monitoring, automated threat detection, and enhanced analytics capabilities are driving the adoption of these systems across various sectors in Germany. In 2025, the market is projected to grow at a CAGR of 10%, reflecting the increasing reliance on sophisticated technologies to combat evolving threats. Organizations are recognizing the importance of integrating cutting-edge solutions to enhance their security posture. This trend suggests that as technology continues to evolve, the intrusion detection-system market will likely expand, offering more effective and efficient security measures.