Expansion of IoT Devices

The proliferation of Internet of Things (IoT) devices is creating new challenges and opportunities for the intrusion detection-system market. As more devices connect to networks, the potential attack surface expands, necessitating advanced security measures to protect against unauthorized access and data breaches. In 2025, it is projected that the number of connected IoT devices will exceed 30 billion, highlighting the urgent need for effective intrusion detection solutions. Organizations are increasingly recognizing the importance of securing these devices, leading to a surge in demand for specialized intrusion detection systems tailored for IoT environments. This trend is likely to drive innovation and growth within the market.

Rising Cybersecurity Threats

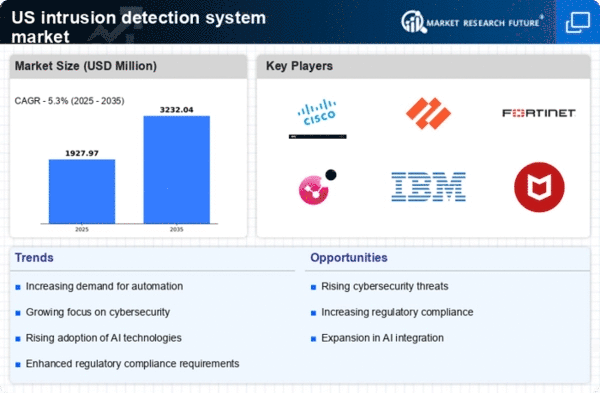

The intrusion detection-system market is experiencing growth due to the increasing frequency and sophistication of cyber threats. Organizations across various sectors are investing heavily in security measures to protect sensitive data and maintain operational integrity. In 2025, it is estimated that cybercrime will cost businesses globally over $10 trillion annually, prompting a surge in demand for advanced intrusion detection systems. This market is projected to grow at a CAGR of approximately 8% from 2025 to 2030, as companies seek to mitigate risks associated with data breaches and unauthorized access. The urgency to safeguard digital assets is driving innovation. This urgency is also leading to the adoption of cutting-edge technologies in the intrusion detection system market.

Growing Awareness of Data Privacy

The intrusion detection-system market is benefiting from a growing awareness of data privacy among consumers and organizations alike. As data breaches become more prevalent, stakeholders are increasingly prioritizing the protection of personal and sensitive information. This heightened awareness is prompting businesses to adopt robust security measures, including intrusion detection systems, to safeguard their data assets. In 2025, surveys indicate that over 70% of consumers are concerned about their data privacy, influencing companies to enhance their security frameworks. This trend is likely to drive significant growth in the intrusion detection-system market as organizations strive to build trust and ensure compliance with privacy standards.

Increased Regulatory Requirements

The intrusion detection-system market is being shaped by heightened regulatory requirements aimed at protecting sensitive information. Organizations are compelled to comply with various regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) and the General Data Protection Regulation (GDPR), which mandate stringent security measures. As compliance becomes a priority, businesses are investing in intrusion detection systems to ensure they meet these legal obligations. In 2025, it is anticipated that compliance-related expenditures will account for over 30% of total cybersecurity budgets, further driving the demand for effective intrusion detection solutions. This trend underscores the critical role of regulatory frameworks in shaping the market landscape.

Technological Advancements in Security Solutions

Technological advancements are significantly influencing the intrusion detection-system market. Innovations such as real-time monitoring, automated threat detection, and enhanced analytics capabilities are becoming essential for organizations aiming to bolster their security posture. The integration of advanced technologies, including machine learning and artificial intelligence, is enabling systems to identify and respond to threats more effectively. As of 2025, the market for intrusion detection systems is expected to reach approximately $5 billion, reflecting a growing recognition of the need for sophisticated security solutions. These advancements not only improve detection rates but also reduce response times, making them critical components in the evolving landscape of cybersecurity.