Increased Cloud Adoption

The shift to cloud computing in Germany is significantly impacting the data encryption market. As businesses migrate their operations to the cloud, the need for secure data transmission and storage becomes paramount. Encryption serves as a critical safeguard against potential vulnerabilities associated with cloud services. In 2025, it is projected that the data encryption market will grow by 13%, fueled by the rising adoption of cloud solutions. Organizations are increasingly recognizing the importance of encrypting data both in transit and at rest to protect against unauthorized access. This trend highlights the necessity for encryption technologies that can seamlessly integrate with cloud infrastructures, thereby driving growth in the data encryption market.

Rising Cybersecurity Threats

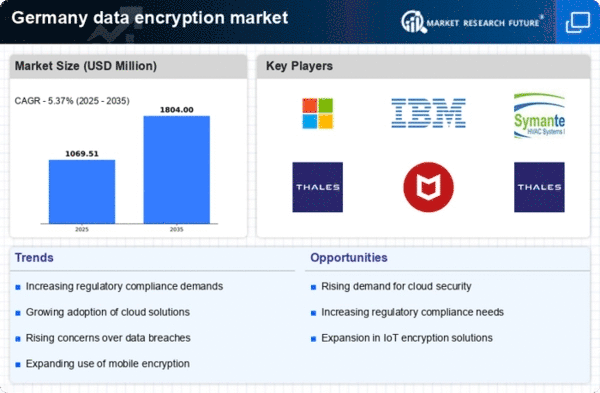

The data encryption market in Germany is growing due to the increasing frequency and sophistication of cyberattacks. Organizations are compelled to adopt robust encryption solutions to safeguard sensitive information from unauthorized access. In 2025, cybercrime is estimated to cost the global economy over $10 trillion annually. This prompts German businesses to prioritize data protection. The urgency to mitigate risks from data breaches has increased the demand for encryption technologies. As a result, the data encryption market is projected to expand significantly, with a compound annual growth rate (CAGR) of approximately 15% over the next five years. This trend underscores the critical role of encryption in enhancing cybersecurity measures across various sectors in Germany.

Growing Demand for Data Privacy

In Germany, the emphasis on data privacy is driving the data encryption market. With the implementation of stringent regulations such as the General Data Protection Regulation (GDPR), organizations are increasingly required to protect personal data. This regulatory landscape has led to a surge in the adoption of encryption technologies to ensure compliance and avoid hefty fines. In 2025, it is anticipated that the data encryption market will witness a growth rate of around 12%, as businesses invest in solutions that enhance data privacy. Consumer trust and the need to secure sensitive information are key factors influencing this trend. Consequently, the data encryption market is becoming an essential component of corporate strategies aimed at safeguarding customer data.

Emerging Threats from IoT Devices

The proliferation of IoT devices in Germany is creating new challenges for data security, influencing the data encryption market. As more devices connect to networks, the potential for data breaches increases, necessitating robust encryption measures. In 2025, the data encryption market is expected to expand by around 11%, as organizations seek to protect sensitive information transmitted by IoT devices. The unique vulnerabilities associated with these devices underscore the importance of implementing encryption solutions that can secure data across diverse platforms. This trend indicates a growing recognition of the need for comprehensive security strategies that encompass the entire ecosystem of connected devices, further propelling the data encryption market.

Technological Advancements in Encryption

The data encryption market in Germany is benefiting from rapid technological advancements. Innovations in encryption algorithms and the development of quantum-resistant encryption methods are enhancing the effectiveness of data protection solutions. As organizations seek to stay ahead of potential threats, the integration of advanced encryption technologies is becoming increasingly prevalent. In 2025, the market is expected to grow by approximately 14%, driven by the demand for more sophisticated encryption solutions. This trend indicates a shift towards adopting cutting-edge technologies that not only secure data but also improve operational efficiency. The data encryption market is thus evolving to meet the challenges posed by emerging technologies and the need for robust security measures.