Growing Cloud Adoption

The rapid adoption of cloud services in France has created new challenges and opportunities for data security. As organizations migrate to cloud-based platforms, the need for encryption solutions to protect sensitive data stored in the cloud becomes increasingly critical. The data encryption market is expected to expand as businesses recognize the importance of encrypting data both in transit and at rest within cloud environments. By 2025, the cloud computing market in France is projected to reach €10 billion, with a significant portion of this growth attributed to the demand for encryption technologies. This trend indicates that organizations are prioritizing data security in their cloud strategies, thereby driving the data encryption market.

Rising Cybersecurity Threats

The increasing frequency and sophistication of cyberattacks in France has heightened the demand for robust data protection measures. As organizations face threats from ransomware, phishing, and data breaches, the data encryption market experiences significant growth. In 2025, it is estimated that the cybersecurity market in France will reach approximately €8 billion, with a substantial portion allocated to encryption solutions. This trend indicates that businesses are prioritizing data security to safeguard sensitive information, thereby driving the data encryption market. The urgency to protect customer data and comply with regulations further propels the adoption of encryption technologies, as organizations seek to mitigate risks associated with data loss and unauthorized access.

Adoption of Remote Work Practices

The shift towards remote work in France has transformed how organizations manage data security. With employees accessing sensitive information from various locations, the need for secure data transmission has become paramount. This trend is likely to drive the data encryption market as businesses seek to protect data in transit and at rest. In 2025, it is anticipated that the demand for encryption solutions will increase by 20% as organizations implement secure remote access protocols. The emphasis on maintaining data integrity and confidentiality in a remote work environment underscores the importance of encryption technologies, thereby propelling the data encryption market forward.

Increased Data Privacy Regulations

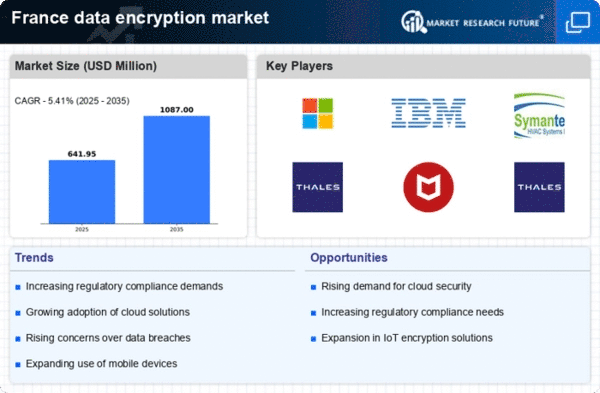

France's stringent data privacy regulations, such as the General Data Protection Regulation (GDPR), compel organizations to implement effective data protection strategies. Compliance with these regulations necessitates the use of encryption technologies to secure personal data. The data encryption market is likely to benefit from this regulatory landscape, as companies invest in encryption solutions to avoid hefty fines and reputational damage. In 2025, it is projected that the market for data encryption in France will grow by approximately 15%, driven by the need for compliance. Organizations are increasingly recognizing that encryption is not just a technical requirement but a critical component of their overall data governance strategy, thus enhancing the data encryption market.

Technological Advancements in Encryption

Innovations in encryption technologies are reshaping the data encryption market in France. Emerging solutions, such as quantum encryption and advanced cryptographic algorithms, offer enhanced security features that appeal to organizations seeking to protect sensitive information. As businesses become more aware of the limitations of traditional encryption methods, the demand for cutting-edge solutions is likely to increase. In 2025, it is estimated that the market for advanced encryption technologies will grow by 25%, reflecting the need for more robust security measures. This trend suggests that organizations are willing to invest in innovative encryption solutions to stay ahead of evolving threats, thereby propelling the data encryption market.