Enhanced Security Features

Security concerns surrounding traditional ATMs have prompted a shift towards cardless solutions in the cardless atm market. With the increasing incidence of card skimming and fraud, consumers are seeking safer alternatives for accessing their funds. Cardless ATMs utilize advanced security measures such as biometric authentication and one-time PINs, which significantly reduce the risk of unauthorized access. In Germany, the implementation of these features is expected to increase consumer trust in digital banking solutions. As a result, financial institutions are likely to invest in upgrading their ATM networks to include cardless options, thereby enhancing the overall security of the cardless atm market. This focus on security not only protects consumers but also strengthens the reputation of banks, potentially leading to increased market share.

Growing Urbanization Trends

Urbanization in Germany is a significant driver for the cardless atm market. As more individuals migrate to urban areas, the demand for convenient banking solutions rises. Urban centers are characterized by a fast-paced lifestyle, where consumers prioritize efficiency and accessibility. The cardless atm market is poised to thrive in these environments, as cardless ATMs offer quick and easy access to cash without the need for physical cards. Furthermore, urban areas often experience higher foot traffic, making it feasible for banks to install more cardless ATMs in strategic locations. This trend is likely to lead to an increase in the number of cardless transactions, as urban consumers seek to streamline their banking experiences.

Consumer Demand for Convenience

The growing consumer demand for convenience is a crucial driver for the cardless atm market. In an era where time is of the essence, individuals are increasingly seeking banking solutions that minimize effort and maximize efficiency. Cardless ATMs cater to this demand by allowing users to withdraw cash without the need for a physical card, streamlining the transaction process. In Germany, surveys indicate that over 60% of consumers prefer banking solutions that offer quick and easy access to funds. This trend is likely to encourage banks to expand their cardless atm offerings, as they strive to meet the evolving expectations of their customers. The cardless atm market is thus positioned to capitalize on this demand for convenience, potentially leading to increased transaction volumes and customer satisfaction.

Integration of Fintech Solutions

The integration of fintech solutions into the banking sector is reshaping the cardless atm market. Fintech companies are developing innovative technologies that enhance the functionality of ATMs, allowing for cardless transactions. In Germany, the collaboration between traditional banks and fintech firms is becoming increasingly common, as both parties recognize the potential for growth in the cardless atm market. This partnership enables banks to leverage cutting-edge technology while fintech companies gain access to established customer bases. As a result, the cardless atm market is likely to see a surge in new features and services, such as mobile wallet integration and real-time transaction notifications, which could further attract tech-savvy consumers.

Increased Digital Payment Adoption

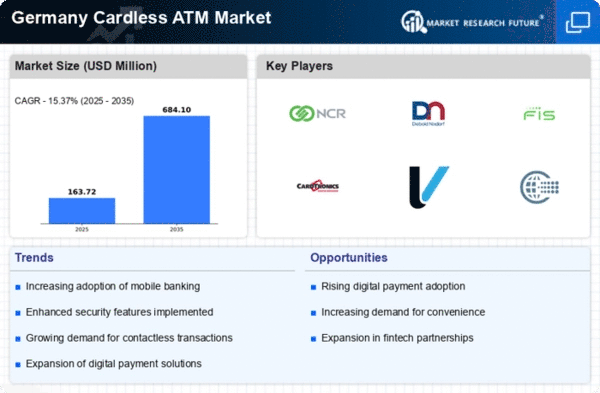

The rise in digital payment adoption in Germany is a pivotal driver for the cardless atm market. As consumers increasingly favor cashless transactions, the demand for innovative banking solutions grows. In 2025, approximately 75% of transactions in Germany are expected to be cashless, indicating a significant shift in consumer behavior. This trend is further supported by the proliferation of mobile banking applications, which facilitate seamless access to funds without the need for physical cards. The cardless atm market is likely to benefit from this transition, as financial institutions invest in technology to enhance user experience and security. Moreover, the convenience of cardless transactions aligns with the fast-paced lifestyle of urban consumers, making it a compelling option for banks to attract and retain customers.