Increased Focus on Safety Standards

The busbar systems market in Germany is driven by an increased focus on safety standards within electrical installations. Regulatory bodies are enforcing stricter safety regulations to mitigate risks associated with electrical failures. Busbar systems, known for their robust design and enhanced safety features, are becoming the preferred choice for many industries. Compliance with these safety standards is essential, and companies are investing in high-quality busbar solutions to ensure adherence. This heightened focus on safety is expected to boost the market by approximately 15% over the next few years, as businesses prioritize risk management in their electrical systems.

Rising Demand for Energy Efficiency

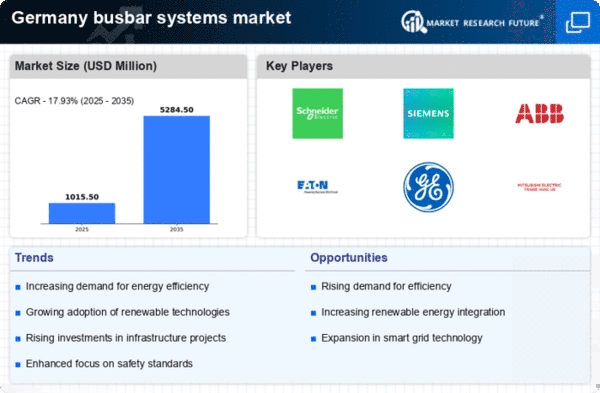

The busbar systems market in Germany is experiencing a notable surge in demand. This is driven by the increasing emphasis on energy efficiency across various sectors. As industries strive to reduce operational costs and enhance sustainability, the adoption of busbar systems is becoming more prevalent. These systems offer superior energy distribution capabilities, which can lead to reductions in energy losses by up to 30%. Furthermore, the German government has set ambitious targets for energy efficiency, aiming for a 50% reduction in energy consumption by 2030. This regulatory framework encourages industries to invest in advanced busbar technologies, thereby propelling growth in the busbar systems market.

Expansion of Renewable Energy Sources

The transition towards renewable energy sources in Germany is significantly influencing the busbar systems market. This shift is creating a growing need for efficient power distribution systems. With the government aiming for 80% of electricity consumption to come from renewable sources by 2050, there is a growing need for efficient power distribution systems. Busbar systems are essential for integrating renewable energy into the grid, as they facilitate the connection of solar panels and wind turbines to the existing infrastructure. This integration is projected to increase the demand for busbar systems by approximately 25% over the next five years, as industries and utilities seek to modernize their energy distribution networks.

Urbanization and Infrastructure Development

Germany's ongoing urbanization and infrastructure development initiatives are contributing to the growth of the busbar systems market. As cities expand and new construction projects emerge, the need for reliable and efficient electrical distribution systems becomes paramount. Busbar systems are increasingly favored in commercial and residential buildings due to their compact design and ease of installation. The construction sector in Germany is expected to grow by 3% annually, likely driving the demand for busbar systems. This trend indicates a robust market potential as urban planners and developers prioritize modern electrical solutions.

Technological Innovations in Electrical Distribution

Innovations in electrical distribution technologies are reshaping the busbar systems market in Germany. The introduction of smart busbar systems, which incorporate IoT and automation, is enhancing operational efficiency and reliability. These advanced systems allow for real-time monitoring and management of electrical loads, reducing downtime and maintenance costs. The market for smart electrical distribution systems is projected to grow by 20% annually, indicating a strong shift towards more intelligent solutions. This trend suggests that companies investing in innovative busbar technologies will likely gain a competitive edge in the evolving market landscape.