Rise of Insurtech Startups

The Blockchain Insurance Market in Germany is witnessing a proliferation of insurtech startups that leverage blockchain technology to innovate traditional insurance models. These startups are focusing on niche markets and offering tailored solutions that address specific consumer needs. In 2025, it is projected that insurtech firms will capture around 25% of the overall insurance market share in Germany. This shift indicates a growing acceptance of blockchain-based solutions among consumers, as these startups often prioritize user experience and transparency. The influx of insurtech companies is likely to drive competition and foster innovation within the blockchain insurance market.

Growing Demand for Transparency

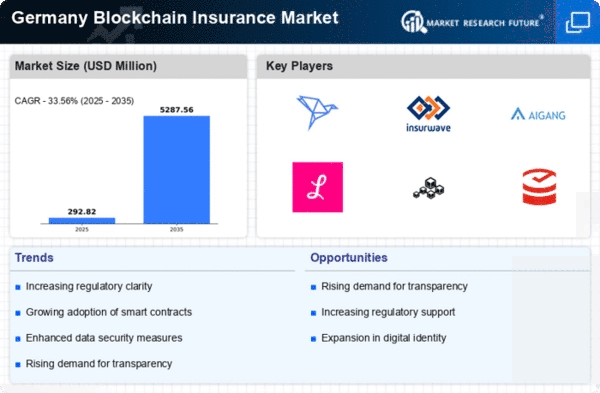

The Blockchain Insurance Market in Germany is experiencing a notable surge in demand for transparency among consumers and businesses alike. This demand is driven by the inherent characteristics of blockchain technology, which offers immutable records and traceability. As consumers become more aware of their rights and the complexities of insurance products, they seek solutions that provide clear insights into policy terms and claims processes. In 2025, it is estimated that approximately 60% of consumers prefer insurance providers that utilize blockchain for transparency. This trend is likely to compel traditional insurers to adopt blockchain solutions to remain competitive in the evolving landscape.

Consumer Education and Awareness

Consumer education and awareness are vital drivers for the Blockchain Insurance Market in Germany. As individuals become more informed about blockchain technology and its applications in insurance, their willingness to engage with blockchain-based products increases. Educational initiatives by insurers and industry associations are expected to enhance understanding of the benefits of blockchain, such as improved claims processing and fraud reduction. By 2025, it is estimated that consumer awareness of blockchain insurance solutions will rise by 40%, leading to greater adoption rates. This heightened awareness is likely to stimulate demand and drive growth within the blockchain insurance market.

Regulatory Framework Development

The development of a supportive regulatory framework is crucial for the growth of the Blockchain Insurance Market in Germany. Regulatory bodies are increasingly recognizing the potential of blockchain technology to enhance efficiency and security in insurance operations. In 2025, it is anticipated that new regulations will be introduced to facilitate the integration of blockchain solutions, thereby providing a clearer operational landscape for insurers. This regulatory support may encourage traditional insurance companies to explore blockchain applications, fostering a more robust and competitive market environment. The alignment of regulations with technological advancements is likely to be a key driver for the blockchain insurance market.

Cost Efficiency through Automation

Cost efficiency is emerging as a pivotal driver in the Blockchain Insurance Market in Germany. The automation of processes through smart contracts can significantly reduce operational costs associated with claims processing and underwriting. By eliminating intermediaries and streamlining workflows, insurers can potentially lower their expenses by up to 30%. This reduction in costs not only benefits insurance companies but also translates to lower premiums for consumers. As the market matures, the adoption of blockchain technology is expected to enhance operational efficiency, thereby attracting more players to the blockchain insurance market.