Growing Demand for Transparency

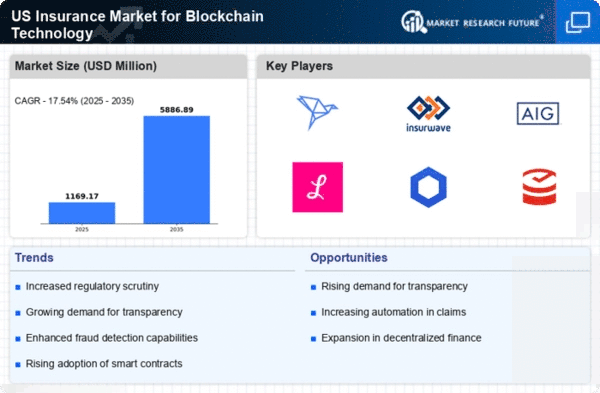

The blockchain insurance market is experiencing a notable surge in demand for transparency among consumers and businesses. This demand stems from the inherent characteristics of blockchain technology, which offers immutable records and traceability. As stakeholders seek to mitigate fraud and enhance trust, the blockchain insurance market is positioned to provide solutions that ensure all transactions are verifiable and transparent. According to recent estimates, the market is projected to grow at a CAGR of approximately 30% over the next five years, driven by this increasing need for transparency. Insurers are likely to leverage blockchain to create more transparent processes, thereby attracting a broader customer base and enhancing their competitive edge.

Cost Efficiency through Automation

Cost efficiency is emerging as a pivotal driver in the blockchain insurance market. The automation capabilities of blockchain technology can significantly reduce operational costs associated with claims processing and underwriting. By utilizing smart contracts, insurers can automate various processes, minimizing the need for manual intervention and reducing the potential for human error. This efficiency not only streamlines operations but also enhances customer satisfaction by expediting claims settlements. Industry reports suggest that companies adopting blockchain solutions could see operational cost reductions of up to 25%, making it an attractive proposition for insurers looking to optimize their financial performance in a competitive landscape.

Enhanced Risk Management Capabilities

The blockchain insurance market is likely to benefit from enhanced risk management capabilities that blockchain technology offers. By providing real-time data sharing and analytics, insurers can better assess risks and tailor their products accordingly. This capability is particularly relevant in sectors such as health and property insurance, where accurate risk assessment is crucial. The integration of blockchain can facilitate more precise underwriting processes, leading to improved pricing models and reduced loss ratios. As the market evolves, insurers that harness these capabilities may gain a competitive advantage, positioning themselves as leaders in risk management within the blockchain insurance market.

Increased Collaboration among Insurers

Collaboration among insurers is becoming increasingly vital in the blockchain insurance market. As the technology matures, insurers are recognizing the potential for shared platforms that enhance data sharing and collective risk assessment. This collaborative approach can lead to the development of innovative insurance products and services that address emerging risks more effectively. By pooling resources and expertise, insurers can create a more resilient ecosystem that benefits all stakeholders. The trend towards collaboration is expected to foster a more interconnected blockchain insurance market, where partnerships can drive innovation and improve overall market efficiency.

Regulatory Support and Framework Development

Regulatory support is a crucial driver for the blockchain insurance market, as it provides the necessary framework for the technology's adoption. As regulators in the US begin to establish guidelines and standards for blockchain applications in insurance, the market is likely to see increased confidence from insurers and consumers alike. This regulatory clarity can facilitate investment in blockchain solutions, encouraging more companies to explore its potential. Furthermore, as compliance becomes more streamlined through blockchain's inherent features, insurers may find it easier to meet regulatory requirements, thereby enhancing their operational efficiency and market positioning.