Regulatory Support

The Biometric ATM Market in Germany benefits from supportive regulatory frameworks that encourage the adoption of biometric technologies. The government has implemented policies aimed at enhancing financial security and promoting innovation in the banking sector. These regulations often provide guidelines for the safe implementation of biometric systems, ensuring compliance with data protection laws. As a result, financial institutions are more inclined to invest in biometric ATMs, knowing they are operating within a supportive legal environment. This regulatory backing is expected to propel the market forward, as banks seek to align with government initiatives aimed at improving security and customer service.

Rising Security Concerns

The Biometric ATM Market in Germany is experiencing growth driven by increasing security concerns among consumers and financial institutions. With the rise in identity theft and fraud, banks are seeking advanced solutions to protect their customers' financial information. Biometric authentication methods, such as fingerprint and facial recognition, provide a higher level of security compared to traditional PIN-based systems. According to recent data, the adoption of biometric systems in ATMs has been linked to a 30% reduction in fraud cases. This trend indicates that as security becomes a priority, the biometric atm market is likely to expand, with institutions investing in these technologies to enhance customer trust and safety.

Technological Integration

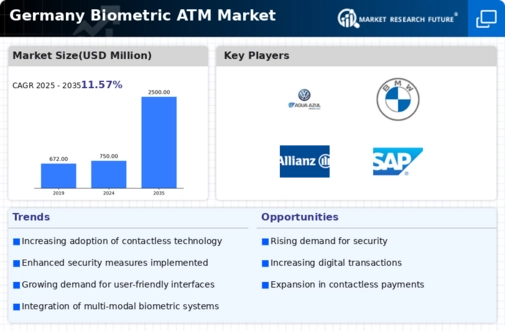

The integration of advanced technologies into the Biometric ATM Market is a significant driver of growth in Germany. Innovations such as artificial intelligence and machine learning are enhancing the capabilities of biometric systems, making them more efficient and user-friendly. For instance, AI algorithms can improve the accuracy of biometric recognition, reducing false rejection rates. As of 2025, it is estimated that the market for biometric ATMs in Germany could reach €500 million, reflecting a compound annual growth rate (CAGR) of 15% over the next five years. This technological evolution not only attracts consumers but also encourages banks to upgrade their existing ATM infrastructure.

Competitive Market Landscape

The competitive landscape of the Biometric ATM Market in Germany is intensifying, with numerous players vying for market share. This competition is driving innovation and reducing costs, making biometric ATMs more accessible to a broader range of financial institutions. Established banks are increasingly collaborating with technology providers to develop customized biometric solutions that cater to their specific needs. As of November 2025, the market is projected to witness a surge in new entrants, further stimulating growth. This competitive environment not only fosters technological advancements but also encourages banks to adopt biometric systems to differentiate themselves in a crowded marketplace.

Consumer Demand for Convenience

Consumer preferences in Germany are shifting towards convenience and efficiency in banking services, which is driving the Biometric ATM Market. Biometric ATMs offer quick and seamless transactions, eliminating the need for remembering PINs or carrying cards. This ease of use appeals to tech-savvy consumers who prioritize speed and convenience in their banking experiences. Market Research Future indicates that approximately 70% of consumers express a preference for biometric authentication methods over traditional ones. As consumer demand for convenient banking solutions continues to rise, financial institutions are likely to invest more in biometric ATMs to meet these expectations and enhance customer satisfaction.