Growing Demand for Targeted Therapies

The increasing prevalence of chronic diseases in Germany is driving the demand for targeted therapies within the biologics market. As healthcare providers seek more effective treatment options, biologics that specifically target disease mechanisms are gaining traction. This shift is reflected in the market, which is projected to reach approximately €10 billion by 2026. The focus on precision medicine aligns with the broader trend of personalized healthcare, where treatments are tailored to individual patient profiles. Consequently, the biologics market is likely to experience robust growth as pharmaceutical companies invest in research and development to create innovative therapies that meet this demand.

Increasing Patient Awareness and Education

Patient awareness and education regarding biologics are growing in Germany, which is influencing the biologics market. As patients become more informed about treatment options, they are more likely to advocate for biologic therapies, particularly for chronic conditions. This trend is supported by healthcare campaigns and educational initiatives aimed at demystifying biologics. The increased demand from patients is prompting healthcare providers to consider biologics as viable treatment options. Consequently, the biologics market is expected to see a rise in adoption rates, further driving market growth.

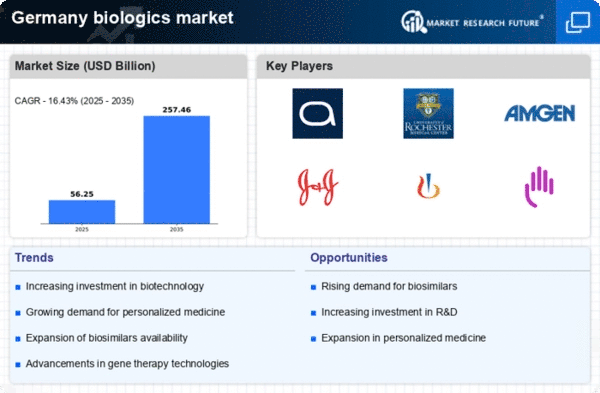

Rising Investment in Biotechnology Research

Investment in biotechnology research is on the rise in Germany, significantly impacting the biologics market. Public and private funding initiatives are being directed towards innovative research projects aimed at developing new biologics. This influx of capital is expected to drive advancements in therapeutic areas such as oncology and autoimmune diseases. Reports indicate that funding for biotechnology research could exceed €1 billion annually by 2027. As research progresses, the biologics market is likely to expand, with new therapies emerging to address unmet medical needs.

Regulatory Support for Biologics Development

The regulatory landscape in Germany is becoming increasingly supportive of biologics development, which is a key driver for the biologics market. The European Medicines Agency (EMA) has implemented streamlined approval processes for biologics, facilitating faster market entry for new therapies. This regulatory environment encourages investment in research and development, as companies are more confident in the approval timelines. As a result, the biologics market is poised for growth, with a projected increase in new product launches. The supportive regulatory framework is likely to enhance the overall competitiveness of the market.

Advancements in Biomanufacturing Technologies

Technological advancements in biomanufacturing are significantly impacting the biologics market in Germany. Innovations such as continuous manufacturing and single-use technologies are enhancing production efficiency and reducing costs. These improvements are crucial as they enable companies to scale up production while maintaining product quality. The market is expected to benefit from these advancements, with estimates suggesting a growth rate of around 8% annually over the next five years. As biomanufacturing becomes more streamlined, it is likely to attract new entrants into the biologics market, fostering competition and innovation.