Urbanization Trends

Rapid urbanization is a significant driver of the Global Geotechnical Engineering Market Industry. As populations migrate to urban areas, the demand for housing, transportation, and utilities escalates, necessitating innovative geotechnical solutions. This urban expansion often leads to complex geological conditions that require specialized engineering expertise. The market's growth trajectory, projected to reach 8.55 USD Billion in 2024, underscores the critical role of geotechnical engineering in addressing the challenges posed by urban development. The industry's ability to provide tailored solutions for diverse urban environments enhances its importance in contemporary engineering practices.

Regulatory Frameworks

The Global Geotechnical Engineering Market Industry is significantly influenced by evolving regulatory frameworks that govern construction and environmental safety. Stricter regulations necessitate compliance with safety standards, prompting increased investment in geotechnical assessments and solutions. This regulatory environment fosters a culture of safety and accountability, driving demand for geotechnical services. As the industry adapts to these changes, it is poised for growth, with projections indicating a market value of 134.9 USD Billion by 2035. The emphasis on regulatory compliance not only enhances public safety but also reinforces the importance of geotechnical engineering in the construction sector.

Market Growth Projections

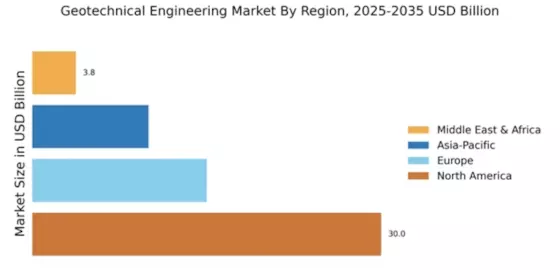

The Global Geotechnical Engineering Market Industry is poised for substantial growth, with projections indicating a market value of 134.9 USD Billion by 2035. This anticipated growth is underpinned by various factors, including infrastructure development, urbanization, and technological advancements. The market is expected to experience a CAGR of 7.85% from 2025 to 2035, reflecting the increasing demand for geotechnical services across diverse sectors. As global economies continue to evolve, the geotechnical engineering sector is likely to play a pivotal role in shaping sustainable and resilient infrastructure solutions.

Infrastructure Development

The Global Geotechnical Engineering Market Industry is experiencing a surge in demand due to extensive infrastructure development projects worldwide. Governments are investing heavily in transportation, energy, and urban development, which necessitates advanced geotechnical solutions. For instance, the global market is projected to reach 58.8 USD Billion in 2024, driven by the need for robust foundations and earth retention systems. This growth is indicative of a broader trend where geotechnical engineering plays a crucial role in ensuring the stability and safety of large-scale projects, thereby enhancing the overall quality of infrastructure.

Technological Advancements

Technological innovations are reshaping the Global Geotechnical Engineering Market Industry, leading to more efficient and effective engineering solutions. The integration of advanced software, geosynthetics, and monitoring technologies has revolutionized traditional practices. For example, the use of 3D modeling and simulation tools allows for precise analysis of soil behavior, which is critical for project success. As these technologies continue to evolve, they are expected to drive market growth at a CAGR of 7.85% from 2025 to 2035, reflecting the industry's adaptability to new methodologies and the increasing complexity of engineering challenges.

Environmental Sustainability

Environmental concerns are increasingly influencing the Global Geotechnical Engineering Market Industry. As nations strive to meet sustainability goals, geotechnical engineers are tasked with developing solutions that minimize environmental impact. Techniques such as soil stabilization and waste containment are gaining traction, reflecting a shift towards eco-friendly practices. The industry's growth is projected to accelerate, with an expected market value of 134.9 USD Billion by 2035. This transition not only addresses regulatory pressures but also aligns with global efforts to combat climate change, thereby enhancing the relevance of geotechnical engineering in sustainable development.