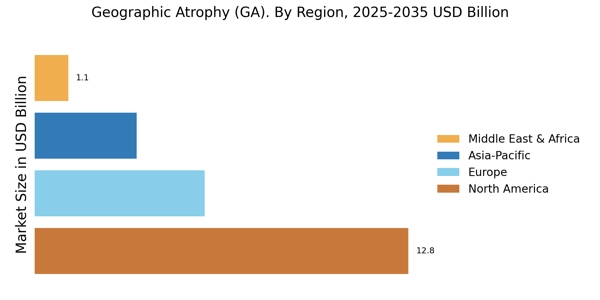

By Region, the study segments the market into North America, Europe, Asia-Pacific, and the Rest of the World. The North America geographic atrophy (GA) market is expected to account for USD XX billion in 2021 and is expected to exhibit an XX% CAGR during the study period. This is attributed to the rising investment in the healthcare industry and the presence of major key players in the region such as Apellis Pharmaceuticals, Inc. (US), Iveric Bio (US), Alkeus Pharmaceuticals Inc. (US), and others.

Moreover, the rising number of patients suffering from geographic atrophy and growing government initiatives related to geographic atrophy in the region further fuel the growth of the market.

Further, the major countries studied are the U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Source Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe geographic atrophy (GA) market is expected to account for the second-largest market share due to the rising older population, increasing demand for technologically innovative treatment, and growing R&D investment by the biopharmaceutical industry. Further, the Germany geographic atrophy (GA) market is expected to hold third place for the market share, and the UK geographic atrophy (GA) market is expected to fastest-growing market, and which is in the 4th place in the European region. Furthermore, France geographic atrophy (GA) market will hold the 5th place for the market share.

The Asia-Pacific geographic atrophy (GA) market is expected to grow at a CAGR of XX% from 2022 to 2030. This is due to the developing healthcare infrastructure, the establishment of research organizations, and the rising prevalence of AMD disorders among the elderly population. Moreover, China geographic atrophy (GA) market is expected to hold the largest market share, and the Geographic atrophy (GA) market is expected fastest-growing market in the Asia-Pacific region.

For instance, According to World Health Organization (WHO), 90% of the total visually impaired people live in developing countries such as China, India, and others, to become the leader in the geographic atrophy (GA) market.

The Rest of the World includes the Middle East, Africa, and Latin America. Government initiatives to increase medical expenditure and increase healthcare infrastructure in the region contribute to the growth of the geographic atrophy (GA) market.