Market Analysis

In-depth Analysis of Generic Pharmaceuticals Market Industry Landscape

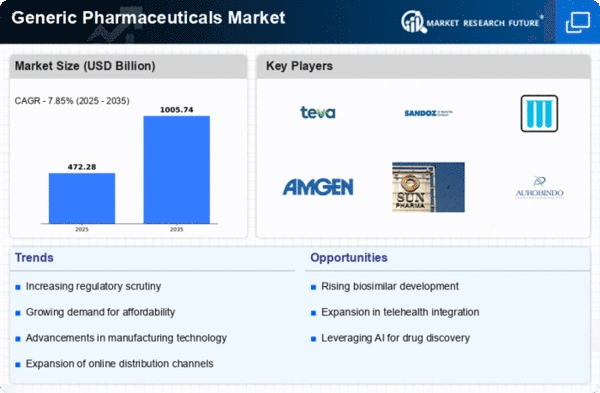

The generic pharmaceuticals market is a dynamic and evolving sector that plays a crucial role in the global healthcare landscape. Generic drugs are bioequivalent versions of brand-name medications, offering the same quality, safety, and efficacy at a fraction of the cost. The market structure of generics is driven by a range of factors that stretch from the supply, through demand to competition. It should be mentioned that one of the main forces which influence the expansion of the generic pharmaceuticals market is the growing demands to lower healthcare expenditure. Different entities in the healthcare system that include governments, treatment facilities and existing consumers seek alternatives to more expensive brand-name medicines. Generic medication manufacturing moves the cost structure in such a way, that a range of more people can afford a crucial treatment. Therefore, the trend of increasing the generic producers does not stop and also on the opposing side, it creates opportunities for manufacturers to meet this rising demand. A merger and alliance are also widely prevalent. The generic drug manufacturing market is being set due to the more acquisitions and mergers of the generic drugmakers but which is through shaping the way of price setting, production capacity, and the market share. Companies which are bigger in size and are quite specialized can be able to conduct research on R&D which is quite complex, thereby developing a generic drug and making them have a larger market and also be more available. Bringing about this perspective, globalization is a major trend which defines the generic pharmaceuticals market dynamics. Manufacturers tend to conduct production and distribution of commodities on a global scale, therefore prefer to source their input materials from different locations and exporters to their products to international communities. Such globalization brings in both opportunities and challenges as companies engage in, various types of economies with different legal structures, expectations from consumers and complicated supply chain networks. Whether it will be possible to keep up with these dynamic global changes in the generic pharmaceuticals is an issue of current interest. Not only do technical novelties, but the generic pharmaceuticals market is also affected by new technologies and innovations. Manufacturing methods have been transformed via continuous manufacturing and 3D printing resulting in quickening of processes and cost saving. Additionally, the development of biosimilars, which are generic versions of biologic drugs, represents a growing segment within the generic pharmaceuticals market, offering alternatives to expensive biological therapies.

Leave a Comment