Top Industry Leaders in the Generative AI in Oil & Gas Market

Competitive Landscape of Generative AI in Oil & Gas Market

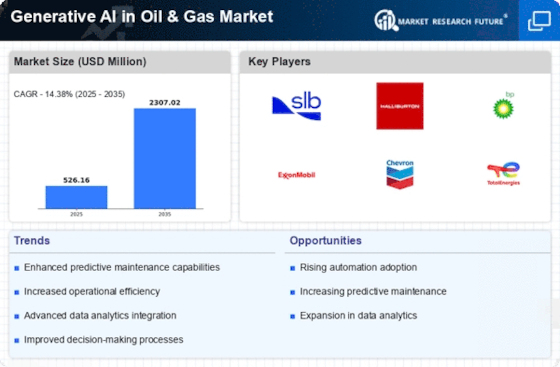

The oil and gas industry, long known for its reliance on brute force technology, is experiencing a seismic shift towards intelligent systems. At the forefront of this transformation stands generative AI, promising to revolutionize exploration, production, and operations.

Key Players:

-

Quantifind

-

OpenAI

-

Accenture

-

DataRobot

-

SAS

-

IBM

-

Microsoft

-

Adobe

-

NVIDIA

-

Intel

-

Google

-

Others

Strategies Adopted:

- Partnerships and Acquisitions: To bridge the gap between AI expertise and oil and gas knowledge, many players are forming strategic partnerships. For example, C3.AI partnered with Halliburton to deliver AI-powered solutions for drilling optimization. Acquisitions are also on the rise, with Shell acquiring AI startup Cognify in 2023 to bolster its in-house capabilities.

- Platform Expansion: Leading players are actively expanding their generative AI platforms to offer end-to-end solutions encompassing data acquisition, processing, modeling, and visualization. This one-stop-shop approach aims to provide oil and gas companies with a seamless path to AI adoption.

- Domain-Specific Solutions: Recognizing the diverse needs of different players within the oil and gas industry, companies are developing targeted solutions for exploration, production, and midstream sectors. This specialization ensures better fit and faster adoption.

Factors for Market Share Analysis:

- Technology Breadth and Depth: The ability to offer a comprehensive suite of generative AI solutions catering to various pain points across the oil and gas value chain will be crucial.

- Domain Expertise: Understanding the intricacies of the oil and gas industry and translating them into effective AI applications will be a key differentiator.

- Data Infrastructure and Security: Access to vast amounts of oil and gas data while ensuring robust security protocols will be critical for developing accurate and reliable models.

- Implementation Support and Training: Providing seamless integration, ongoing support, and training for oil and gas companies will be essential for successful adoption.

New and Emerging Companies:

Several new players are emerging, driven by the immense potential of generative AI in oil and gas. Companies like Exyn Technologies, Akur8, and Seeq are focusing on specific areas like autonomous robotics, subsurface reservoir characterization, and real-time operational analytics. These innovative approaches hold the potential to disrupt traditional methods and drive further market growth.

Current Company Investment Trends:

- Focus on Predictive Maintenance: Generative AI is increasingly being deployed for predictive maintenance of critical equipment, minimizing downtime and optimizing operations.

- Reservoir Modeling and Simulation: Accurately simulating reservoir behavior for efficient hydrocarbon extraction is a major area of investment. Generative AI models are allowing for more precise predictions and improved drilling strategies.

- Sustainability and Environmental Impact: Minimizing the environmental footprint of oil and gas operations is becoming a key focus. Generative AI is being used to optimize processes and reduce emissions.

Latest Industry News:

Jan 25, 2024: Chevron, a major oil and gas producer, has partnered with C3.AI, a leading AI software provider, to develop and deploy AI-powered drilling optimization solutions. This collaboration aims to improve drilling efficiency, reduce costs, and enhance operational safety.

Jan 20, 2024: Shell, a global energy giant, is piloting the use of generative AI for seismic data interpretation in the North Sea. This project aims to improve the accuracy and efficiency of identifying potential hydrocarbon reserves, potentially leading to faster and more cost-effective exploration.

Jan 15, 2024: Schlumberger, a leading oilfield services provider, has launched a new generative AI platform called "Petrel AI" specifically designed for reservoir modeling. This platform uses AI to generate high-fidelity reservoir models, enabling more informed decisions about drilling and production strategies.

Jan 10, 2024: Baker Hughes, another major oilfield services company, has partnered with Microsoft to develop AI-powered solutions for wellbore integrity management. This collaboration aims to prevent wellbore failures and ensure the safety of oil and gas operations.

Jan 5, 2024: Exyn Technologies, a startup focusing on autonomous robotics in the oil and gas industry, has secured $100 million in funding to further develop its AI-powered robots for pipeline inspection and maintenance. This funding highlights the growing interest in using generative AI for automating hazardous tasks in the oil and gas sector.

Dec 20, 2023: The World Economic Forum has released a report outlining the potential of generative AI to optimize oil and gas production while minimizing environmental impact. The report identifies opportunities for using AI to reduce emissions, improve water management, and enhance operational efficiency.

Dec 15, 2023: IBM and BP, a major oil and gas company, have announced a partnership to develop generative AI solutions for carbon capture and storage (CCS). This collaboration aims to accelerate the development of CCS technologies, which are critical for reducing greenhouse gas emissions from the oil and gas industry.