Advancements in Genomic Technologies

Technological innovations in genomic sequencing and analysis are significantly influencing the gene expression-analysis market. The advent of next-generation sequencing (NGS) technologies has revolutionized the way gene expression data is collected and analyzed. These advancements have led to a reduction in costs, with sequencing prices dropping by over 90% in the last decade. As a result, researchers and clinicians are increasingly adopting these technologies to gain insights into gene expression patterns. The gene expression-analysis market is expected to benefit from the proliferation of high-throughput sequencing methods, which allow for the simultaneous analysis of thousands of genes. This trend not only enhances the efficiency of research but also accelerates the pace of discoveries in genomics, thereby driving market growth.

Rising Demand for Precision Medicine

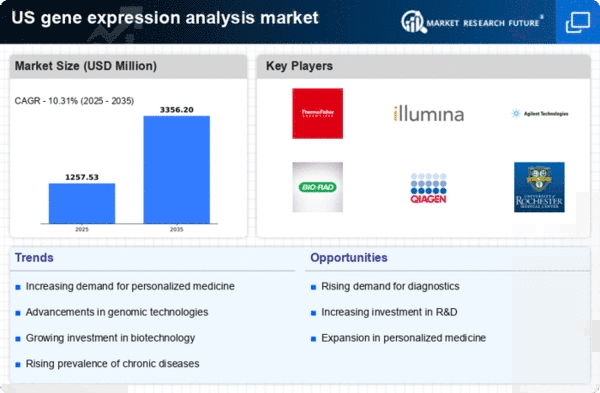

The increasing emphasis on precision medicine is a pivotal driver for the gene expression-analysis market. As healthcare shifts towards more personalized treatment approaches, the need for accurate gene expression data becomes paramount. This market is projected to grow at a CAGR of approximately 10% from 2025 to 2030, reflecting the rising demand for tailored therapies. Healthcare providers and researchers are increasingly relying on gene expression analysis to identify biomarkers and develop targeted treatments, thereby enhancing patient outcomes. The integration of gene expression data into clinical workflows is expected to streamline the drug development process, making it more efficient and cost-effective. Consequently, The gene expression analysis market is likely to experience substantial growth.

Growing Awareness of Genetic Disorders

The rising awareness of genetic disorders among the general public and healthcare professionals is propelling the gene expression-analysis market forward. As more individuals seek genetic testing and counseling, the demand for comprehensive gene expression analysis increases. Educational campaigns and initiatives by health organizations have contributed to a better understanding of the implications of genetic variations on health. This heightened awareness is leading to an increase in diagnostic testing, which often incorporates gene expression analysis to provide insights into disease predisposition and treatment options. Consequently, The gene expression analysis market is poised for growth.

Increased Funding for Genomic Research

The gene expression analysis market is experiencing a surge in funding. Government initiatives and grants aimed at advancing genomic research have increased significantly, with funding levels reaching approximately $1.5 billion in 2025. This financial support is directed towards innovative research projects that utilize gene expression analysis to explore various diseases, including cancer and genetic disorders. The influx of capital enables researchers to access advanced technologies and methodologies, thereby enhancing the quality and scope of their studies. As funding continues to rise, the gene expression-analysis market is likely to expand, fostering an environment conducive to groundbreaking discoveries and advancements in the field.

Collaborations Between Academia and Industry

Collaborative efforts between academic institutions and industry players are emerging as a significant driver for the gene expression-analysis market. These partnerships facilitate the exchange of knowledge, resources, and technologies, ultimately accelerating research and development in the field. By pooling expertise, both sectors can address complex challenges in gene expression analysis, leading to innovative solutions and products. Such collaborations often result in the commercialization of research findings, which can enhance the availability of advanced gene expression analysis tools and services. As these partnerships continue to flourish, the gene expression-analysis market is likely to benefit from increased innovation and a more robust pipeline of products, thereby meeting the growing demands of researchers and clinicians.