Rising Geriatric Population

The increasing geriatric population in the GCC is a pivotal driver for the urinary catheters market. As life expectancy rises, the number of elderly individuals requiring medical care for urinary issues is also growing. It is estimated that by 2030, the geriatric population in the GCC will account for over 15% of the total population. This demographic shift is likely to lead to a higher prevalence of urinary disorders, thereby increasing the demand for urinary catheters. Healthcare systems are adapting to this trend by enhancing services tailored to the elderly, which includes the provision of urinary catheters. Consequently, the urinary catheters market is expected to experience robust growth as it aligns with the needs of this expanding patient group.

Expansion of Healthcare Infrastructure

The ongoing expansion of healthcare infrastructure in the GCC is a significant driver for the urinary catheters market. Governments in the region are investing heavily in healthcare facilities, aiming to improve access to medical services for their populations. This expansion includes the establishment of new hospitals and clinics, which are increasingly equipped with advanced medical technologies. As these facilities become operational, the demand for urinary catheters is expected to rise correspondingly. Moreover, the introduction of specialized urology departments within hospitals is likely to further stimulate market growth. The urinary catheters market is poised to benefit from this infrastructural development, as healthcare providers seek to offer comprehensive care for patients with urinary conditions.

Growing Awareness of Infection Control

The heightened awareness surrounding infection control practices is a crucial driver for the urinary catheters market. In the GCC, healthcare institutions are prioritizing the implementation of stringent infection prevention protocols, particularly in catheter-associated urinary tract infections (CAUTIs). This focus on infection control is leading to increased adoption of advanced urinary catheters designed to minimize infection risks. Recent studies indicate that the use of antimicrobial catheters can reduce CAUTI rates by up to 50%. Consequently, healthcare providers are more inclined to invest in high-quality urinary catheters that align with these infection control measures. This trend is likely to bolster the urinary catheters market as hospitals and clinics seek to enhance patient safety and care quality.

Increasing Prevalence of Urinary Disorders

The rising incidence of urinary disorders in the GCC region is a primary driver for the urinary catheters market. Conditions such as urinary incontinence, benign prostatic hyperplasia, and urinary tract infections are becoming more prevalent, particularly among the aging population. According to recent health statistics, the prevalence of urinary incontinence is estimated to affect approximately 30% of older adults in the region. This growing patient demographic necessitates the use of urinary catheters, thereby propelling market growth. Furthermore, healthcare providers are increasingly recognizing the need for effective management of these conditions, which further stimulates demand for urinary catheters. As a result, the urinary catheters market is expected to expand significantly, driven by the need to address these health challenges.

Technological Innovations in Catheter Design

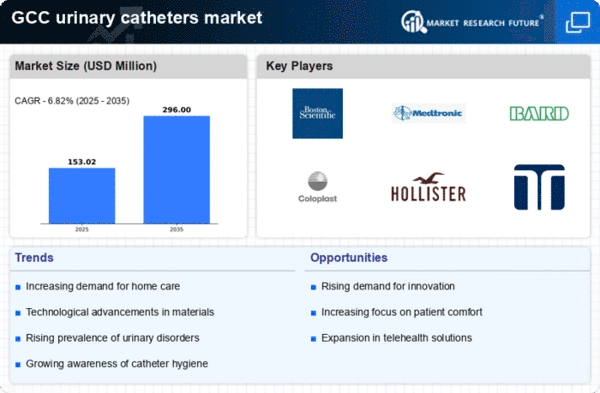

Technological advancements in catheter design are significantly influencing the urinary catheters market. Innovations such as the development of hydrophilic-coated catheters and antimicrobial materials are enhancing patient comfort and reducing the risk of infections. These advancements are particularly relevant in the GCC, where healthcare facilities are increasingly adopting state-of-the-art medical devices. The market for urinary catheters is projected to grow at a CAGR of around 6% over the next few years, driven by these innovations. Additionally, the introduction of smart catheters equipped with sensors for monitoring urinary output is expected to revolutionize patient care. Such technologies not only improve clinical outcomes but also align with the region's focus on enhancing healthcare quality.