Increased Healthcare Expenditure

The rise in healthcare expenditure in the UK is a significant driver for the urinary catheters market. With the National Health Service (NHS) and private healthcare providers investing more in advanced medical technologies, there is a growing focus on improving patient care and outcomes. In recent years, healthcare spending has increased by approximately 4% annually, reflecting a commitment to enhancing healthcare services. This trend is likely to benefit the urinary catheters market, as hospitals and clinics seek to procure high-quality catheters that meet the needs of their patients. Furthermore, increased funding for research and development in medical devices is expected to lead to the introduction of innovative catheter solutions, thereby expanding the market. As healthcare budgets continue to grow, the urinary catheters market is poised for substantial growth.

Innovations in Catheter Technology

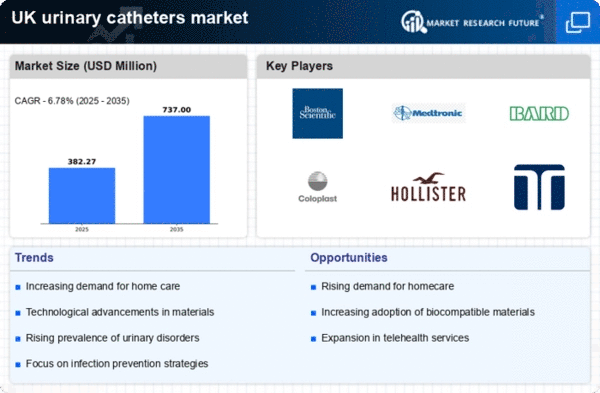

Technological advancements in catheter design and materials are driving growth in the urinary catheters market. Innovations such as antimicrobial coatings, hydrophilic catheters, and self-lubricating features are enhancing patient comfort and reducing the risk of infections. For instance, the introduction of silicone catheters has been associated with lower rates of urinary tract infections compared to traditional latex options. The market for urinary catheters is projected to grow at a CAGR of around 6% over the next few years, driven by these technological improvements. Additionally, the development of smart catheters equipped with sensors for monitoring urinary output is likely to attract interest from healthcare providers, further stimulating market growth. These innovations not only improve patient outcomes but also align with the increasing demand for minimally invasive medical devices.

Rising Awareness of Infection Control

The heightened awareness of infection control practices in healthcare settings is influencing the urinary catheters market. With the increasing emphasis on preventing healthcare-associated infections (HAIs), hospitals are adopting stringent protocols for catheter use. This shift is driving demand for advanced urinary catheters that minimize infection risks, such as those with antimicrobial properties. The UK government has implemented various initiatives aimed at reducing HAIs, which has led to a greater focus on the quality and safety of medical devices. As a result, healthcare providers are more inclined to invest in urinary catheters that align with these infection control measures. This trend is likely to foster growth in the urinary catheters market, as providers seek to enhance patient safety and comply with regulatory standards.

Rising Incidence of Urinary Disorders

The increasing prevalence of urinary disorders in the UK is a notable driver for the urinary catheters market. Conditions such as urinary incontinence, benign prostatic hyperplasia, and urinary tract infections are becoming more common, particularly among the aging population. According to recent health statistics, approximately 14% of adults in the UK experience some form of urinary incontinence, which necessitates the use of catheters. This growing patient base is likely to propel demand for urinary catheters, as healthcare providers seek effective solutions to manage these conditions. Furthermore, the rising awareness of urinary health issues is encouraging patients to seek medical advice, thereby increasing the market's potential. As a result, the urinary catheters market is expected to expand significantly in response to these trends.

Growing Demand for Home Healthcare Solutions

The increasing preference for home healthcare solutions is emerging as a key driver for the urinary catheters market. As patients seek to manage their health conditions in the comfort of their homes, the demand for home-use catheters is on the rise. This trend is particularly evident among elderly patients and those with chronic conditions who require long-term catheterization. The UK healthcare system is adapting to this shift by promoting home healthcare services, which is likely to boost the urinary catheters market. Additionally, advancements in catheter design that facilitate ease of use for patients and caregivers are further supporting this trend. As the home healthcare sector continues to expand, the urinary catheters market is expected to benefit from increased demand for convenient and effective catheter solutions.