Rising Security Concerns

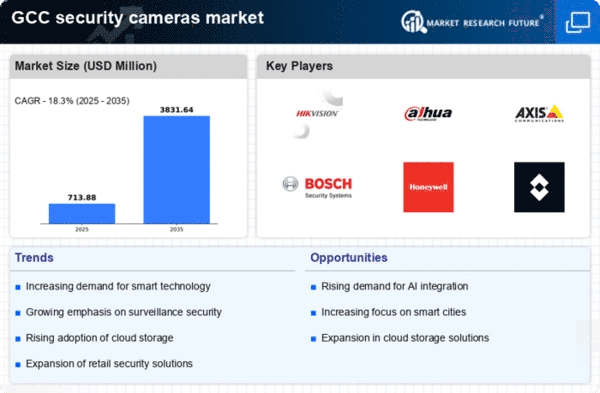

The increasing incidence of crime and security threats in the GCC region has led to a heightened demand for surveillance solutions. As urbanization accelerates, cities are becoming more vulnerable to various security challenges. The security cameras market is experiencing growth as businesses and homeowners seek to enhance their security measures. According to recent data, the market is projected to grow at a CAGR of 12% from 2025 to 2030. This trend indicates that stakeholders are prioritizing safety, thereby driving investments in advanced security camera systems. The security cameras market is adapting to these needs by offering innovative solutions that cater to both residential and commercial sectors.

Government Initiatives and Regulations

Governments in the GCC are increasingly implementing regulations that mandate the installation of security cameras in public spaces and critical infrastructure. These initiatives aim to bolster public safety and enhance surveillance capabilities. For instance, the introduction of laws requiring surveillance in commercial establishments has significantly impacted the security cameras market. The market is expected to benefit from these regulatory frameworks, which not only promote safety but also encourage technological advancements. The security cameras market is likely to see a surge in demand as compliance with these regulations becomes essential for businesses and public entities.

Growing Demand for Smart Home Solutions

The trend towards smart home technology is significantly influencing the security cameras market. Consumers are increasingly seeking integrated security solutions that can be managed through mobile applications and smart devices. This shift is prompting manufacturers to develop security cameras that are compatible with smart home ecosystems. The market is projected to grow as more households adopt these technologies, with estimates suggesting a potential increase of 15% in market size by 2027. The security cameras market is thus evolving to meet the expectations of tech-savvy consumers who prioritize convenience and connectivity.

Expansion of E-commerce and Retail Sectors

The growth of e-commerce and retail sectors in the GCC is driving the demand for enhanced security measures, including surveillance systems. As online shopping continues to rise, brick-and-mortar stores are investing in security cameras to protect their assets and ensure customer safety. This trend is expected to contribute to a robust growth trajectory for the security cameras market, with projections indicating a market value increase of $1 billion by 2028. The security cameras market is responding to this demand by offering tailored solutions that address the unique security challenges faced by retailers.

Technological Advancements in Surveillance

The rapid evolution of technology is transforming the security cameras market, particularly in the GCC region. Innovations such as high-definition video, night vision, and smart analytics are becoming standard features in modern security cameras. These advancements enhance the effectiveness of surveillance systems, making them more appealing to consumers. The integration of IoT capabilities allows for remote monitoring and control, further driving market growth. As a result, the security cameras market is witnessing an influx of new products that cater to the sophisticated needs of users, thereby expanding the overall market landscape.