Surge in Healthcare Expenditure

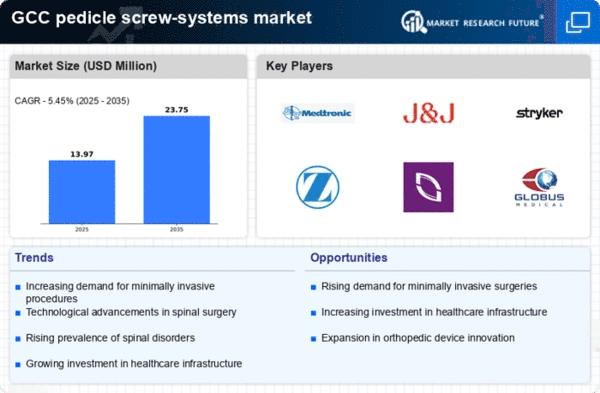

Healthcare expenditure in the GCC countries has been on an upward trajectory, which positively influences the pedicle screw-systems market. Governments and private sectors are investing heavily in healthcare infrastructure, with budgets allocated for advanced medical technologies. For instance, healthcare spending in the GCC is projected to reach approximately $100 billion by 2025, reflecting a commitment to improving healthcare services. This increase in funding allows hospitals and surgical centers to acquire state-of-the-art equipment, including pedicle screw systems, which are essential for spinal surgeries. Enhanced financial resources enable healthcare facilities to adopt innovative solutions, thereby driving the demand for these systems in the market.

Increasing Incidence of Spinal Disorders

The rising prevalence of spinal disorders in the GCC region is a primary driver for the pedicle screw-systems market. Conditions such as degenerative disc disease, scoliosis, and spinal stenosis are becoming more common, leading to an increased demand for surgical interventions. According to recent health statistics, spinal disorders account for a significant portion of musculoskeletal disorders, with estimates suggesting that around 30% of the population may experience some form of spinal issue. This growing patient population necessitates advanced surgical solutions, including pedicle screw systems, to ensure effective treatment outcomes. As healthcare providers seek to enhance surgical precision and patient recovery, the demand for innovative pedicle screw technologies is likely to rise, thereby propelling market growth.

Regulatory Support for Advanced Medical Devices

Regulatory bodies in the GCC are increasingly supportive of the introduction and use of advanced medical devices, including pedicle screw systems. Streamlined approval processes and initiatives aimed at fostering innovation are encouraging manufacturers to develop and market new products. This regulatory environment is conducive to the growth of the pedicle screw-systems market, as it allows for quicker access to cutting-edge technologies. Furthermore, collaboration between regulatory agencies and industry stakeholders is enhancing the overall quality and safety of medical devices. As a result, healthcare providers are more likely to adopt these advanced systems, thereby driving market expansion.

Technological Innovations in Surgical Equipment

Technological advancements in surgical equipment are driving the evolution of the pedicle screw-systems market. Innovations such as 3D printing, robotic-assisted surgery, and advanced imaging techniques are enhancing the precision and effectiveness of spinal surgeries. These technologies not only improve surgical outcomes but also reduce the risk of complications, which is crucial for patient safety. The integration of smart technologies into pedicle screw systems is becoming increasingly prevalent, with features that allow for real-time monitoring and adjustments during surgery. As these innovations continue to emerge, they are likely to attract investment and interest from healthcare providers, further stimulating market growth.

Growing Awareness of Minimally Invasive Techniques

There is a notable shift towards minimally invasive surgical techniques within the GCC, which is significantly impacting the pedicle screw-systems market. Patients and healthcare professionals are increasingly recognizing the benefits of such procedures, including reduced recovery times and lower complication rates. As a result, the demand for pedicle screw systems that facilitate minimally invasive surgeries is likely to increase. Market data indicates that minimally invasive spinal surgeries are expected to grow at a CAGR of over 10% in the coming years. This trend suggests that manufacturers of pedicle screw systems may need to innovate and adapt their products to meet the evolving preferences of both surgeons and patients.