Growing Automotive Sector

The paints coatings market is experiencing growth driven by the expanding automotive sector in the GCC region. With an increase in vehicle production and sales, the demand for high-quality automotive coatings is on the rise. This sector requires specialized coatings that offer durability, aesthetic appeal, and protection against environmental factors. The paints coatings market is responding to this demand by developing advanced coatings that meet the specific needs of automotive manufacturers. Market data indicates that the automotive segment accounts for approximately 25% of the total market share, underscoring its significance. As the automotive industry continues to evolve, particularly with the rise of electric vehicles, the need for innovative coatings that enhance performance and sustainability is likely to grow, presenting new opportunities for manufacturers.

Increased Focus on Aesthetics

In the paints coatings market, there is a notable shift towards aesthetic appeal, particularly in residential and commercial spaces. Consumers are increasingly prioritizing the visual aspects of their environments, leading to a higher demand for decorative paints and coatings. This trend is particularly pronounced in urban areas, where the competition among businesses to attract customers drives the need for visually appealing storefronts and interiors. The paints coatings market is responding to this demand by introducing a variety of colors, textures, and finishes. Market data indicates that decorative coatings account for nearly 40% of the total market share, highlighting the importance of aesthetics in driving sales. As consumers become more discerning, manufacturers are likely to invest in research and development to create innovative products that cater to these preferences.

Rising Construction Activities

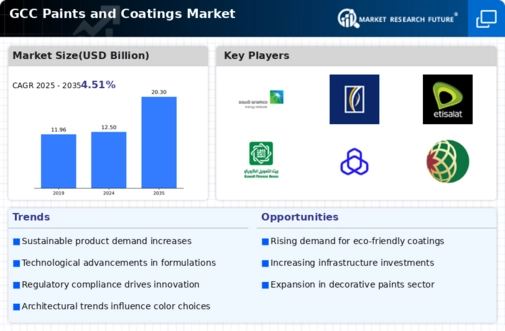

The paints coatings market is experiencing a surge due to the increasing construction activities across the GCC region. With a projected growth rate of approximately 6.5% annually, the demand for paints and coatings is expected to rise significantly. This growth is driven by both residential and commercial projects, as governments invest heavily in infrastructure development. The paints coatings market benefits from this trend, as new buildings require high-quality finishes and protective coatings. Additionally, the expansion of the hospitality and tourism sectors in countries like the UAE and Saudi Arabia further fuels the demand for aesthetic and durable coatings. As a result, manufacturers are likely to innovate and diversify their product offerings to meet the evolving needs of the construction sector.

Regulatory Compliance and Standards

The paints coatings market is significantly influenced by the increasing regulatory compliance and standards imposed by governments in the GCC region. Stricter environmental regulations are pushing manufacturers to develop low-VOC and eco-friendly products. This shift not only aligns with global sustainability trends but also meets the growing consumer demand for safer and healthier living environments. The paints coatings market is adapting by reformulating existing products and investing in new technologies to comply with these regulations. As a result, the market is witnessing a gradual transition towards sustainable practices, which could potentially enhance brand loyalty among environmentally conscious consumers. Furthermore, compliance with these standards may open up new market opportunities, particularly in sectors such as construction and automotive, where regulations are becoming increasingly stringent.

Technological Innovations in Coatings

Technological advancements are playing a crucial role in shaping the paints coatings market. Innovations such as nanotechnology and smart coatings are emerging, offering enhanced performance characteristics like self-cleaning and anti-corrosion properties. These advancements are particularly relevant in the GCC region, where extreme weather conditions can impact the durability of coatings. The paints coatings market is likely to benefit from these innovations, as they provide solutions that meet the specific challenges faced by consumers and businesses in harsh environments. Market analysts suggest that the adoption of these technologies could lead to a competitive edge for manufacturers, as they cater to the growing demand for high-performance coatings. As a result, investment in R&D is expected to increase, driving further innovation in the sector.