Regulatory Compliance

Regulatory compliance is becoming increasingly stringent, influencing the Hi-Tech Paints and Coatings Market. Governments worldwide are implementing stricter regulations regarding the use of hazardous substances in coatings, which is prompting manufacturers to reformulate their products. This shift towards compliance not only ensures safety but also opens avenues for the development of advanced, safer alternatives. The market is witnessing a rise in demand for compliant products, particularly in regions with rigorous environmental standards. As a result, companies that proactively adapt to these regulations are likely to gain a competitive edge. The focus on compliance is expected to drive innovation and investment in the Hi-Tech Paints and Coatings Market.

Technological Innovations

Technological advancements are playing a pivotal role in the evolution of the Hi-Tech Paints and Coatings Market. Innovations such as nanotechnology and smart coatings are enhancing product performance and functionality. For instance, self-cleaning and anti-microbial coatings are gaining traction, particularly in sectors like healthcare and construction. The integration of digital technologies, including IoT, is also enabling real-time monitoring of coating performance, which could lead to improved maintenance and longevity. Market data indicates that the segment of smart coatings is expected to expand rapidly, with a projected growth rate of around 7% annually. This technological evolution is likely to create new opportunities and applications within the Hi-Tech Paints and Coatings Market.

Sustainability Initiatives

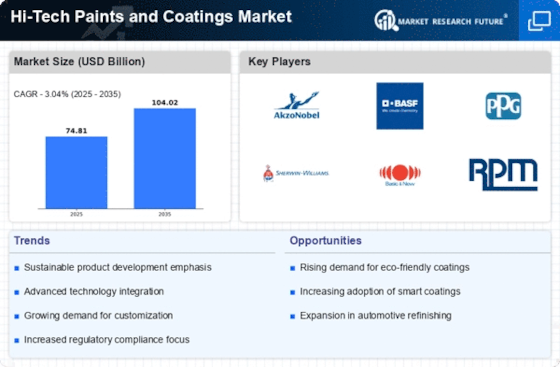

The increasing emphasis on sustainability within the Hi-Tech Paints and Coatings Market is driving innovation and product development. Manufacturers are focusing on eco-friendly formulations that reduce environmental impact. This shift is evident as the market for low-VOC and water-based paints is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 5% in the coming years. Companies are investing in research to develop sustainable raw materials, which not only meet regulatory standards but also appeal to environmentally conscious consumers. As a result, the Hi-Tech Paints and Coatings Market is witnessing a transformation towards greener alternatives, which could potentially reshape consumer preferences and purchasing behaviors.

Expansion of End-Use Industries

The expansion of various end-use industries is significantly influencing the Hi-Tech Paints and Coatings Market. Sectors such as automotive, aerospace, and construction are experiencing robust growth, which in turn drives demand for advanced coatings. For example, the automotive industry is increasingly adopting high-performance coatings to enhance vehicle aesthetics and durability. Market analysis suggests that the automotive coatings segment alone could reach a valuation of several billion dollars by 2026. Additionally, the construction sector's recovery and growth are leading to increased investments in infrastructure, further propelling the demand for innovative paint solutions. This trend indicates a strong correlation between end-use industry growth and the Hi-Tech Paints and Coatings Market.

Consumer Preferences for Performance

Consumer preferences are shifting towards high-performance coatings, which is a key driver in the Hi-Tech Paints and Coatings Market. Customers are increasingly seeking products that offer superior durability, aesthetic appeal, and functionality. This trend is particularly evident in sectors such as residential and commercial construction, where the demand for long-lasting and visually appealing finishes is on the rise. Market data indicates that the demand for high-performance coatings is expected to grow at a rate of approximately 6% annually. As consumers become more discerning, manufacturers are compelled to innovate and enhance their product offerings to meet these evolving expectations. This focus on performance is likely to shape the future landscape of the Hi-Tech Paints and Coatings Market.