Increasing Aging Population

The ophthalmic drugs market is experiencing growth due to the increasing aging population in the GCC region. As individuals age, they become more susceptible to various eye disorders, such as cataracts and age-related macular degeneration. This demographic shift is projected to lead to a higher demand for ophthalmic medications. According to recent estimates, the population aged 65 and above in the GCC is expected to reach approximately 10% by 2030. This trend indicates a growing market for ophthalmic drugs, as older adults typically require more frequent eye care and treatment. Consequently, pharmaceutical companies are likely to focus on developing innovative therapies tailored to this demographic, thereby driving the overall growth of the ophthalmic drugs market.

Rising Healthcare Expenditure

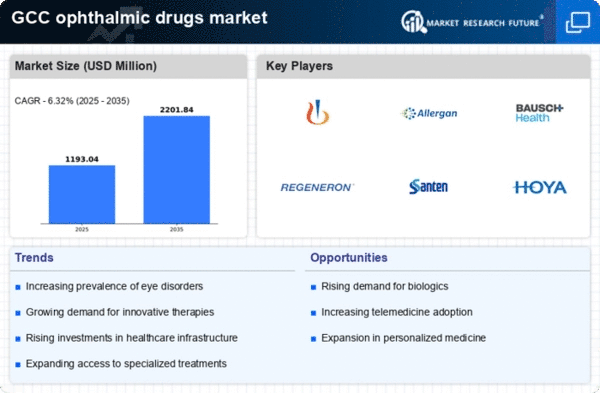

Healthcare expenditure in the GCC is on the rise, which positively impacts the ophthalmic drugs market. Governments in the region are investing significantly in healthcare infrastructure and services, leading to improved access to eye care. For instance, healthcare spending in the GCC is projected to reach $104 billion by 2025, reflecting a compound annual growth rate (CAGR) of around 7%. This increase in funding allows for better diagnostic tools and treatment options, enhancing the quality of care for patients with eye conditions. As a result, the demand for ophthalmic drugs is likely to grow, as healthcare providers are better equipped to diagnose and treat various ocular diseases, thus expanding the market.

Growing Awareness of Eye Health

There is a notable increase in awareness regarding eye health among the population in the GCC, which is contributing to the growth of the ophthalmic drugs market. Public health campaigns and educational initiatives are encouraging individuals to seek regular eye examinations and treatment for eye disorders. This heightened awareness is likely to lead to earlier diagnosis and treatment of conditions such as glaucoma and diabetic retinopathy. As more people recognize the importance of eye health, the demand for ophthalmic medications is expected to rise. Furthermore, the increasing prevalence of lifestyle-related eye issues, such as digital eye strain, is also driving the need for effective ophthalmic solutions, thereby positively influencing the market.

Regulatory Support for New Drug Approvals

Regulatory bodies in the GCC are increasingly supportive of new drug approvals, which is beneficial for the ophthalmic drugs market. Streamlined approval processes and incentives for innovation are encouraging pharmaceutical companies to invest in research and development of new ophthalmic therapies. This regulatory environment is likely to facilitate the introduction of novel drugs that address unmet medical needs in the field of ophthalmology. As a result, the market may witness a surge in the availability of advanced treatment options for patients suffering from various eye disorders. The proactive stance of regulatory agencies is expected to enhance competition among manufacturers, ultimately benefiting consumers through improved access to effective ophthalmic drugs.

Technological Advancements in Drug Delivery

Technological advancements in drug delivery systems are playing a crucial role in shaping the ophthalmic drugs market. Innovations such as sustained-release formulations and nanotechnology are enhancing the efficacy and safety of ophthalmic medications. These advancements allow for targeted delivery of drugs to the ocular tissues, improving therapeutic outcomes and patient compliance. For instance, the development of eye drops with enhanced penetration capabilities is likely to reduce the frequency of administration, making treatment more convenient for patients. As these technologies continue to evolve, they are expected to attract investment and research in the ophthalmic drugs market, fostering growth and expanding treatment options for various eye conditions.