Increased Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices in the GCC is significantly influencing the location analytics market. As more devices become interconnected, the volume of location-based data generated is expanding rapidly. This influx of data presents opportunities for businesses to harness insights that can drive operational improvements and enhance customer experiences. For instance, logistics companies are utilizing location analytics to optimize supply chain routes and reduce operational costs. It is estimated that the number of IoT devices in the region will reach over 1 billion by 2026, further fueling the demand for location analytics solutions. This trend indicates a growing recognition of the importance of real-time data in decision-making processes, thereby solidifying the role of the location analytics market in various industries.

Emergence of Advanced Analytics Tools

The emergence of advanced analytics tools is reshaping the landscape of the location analytics market. Organizations in the GCC are increasingly adopting sophisticated software solutions that integrate machine learning and predictive analytics capabilities. These tools enable businesses to analyze complex datasets and derive actionable insights with greater accuracy. For example, financial institutions are utilizing location analytics to assess risk and enhance fraud detection mechanisms. The market for advanced analytics tools is projected to grow by approximately 18% annually, reflecting the increasing reliance on data-driven strategies. As companies seek to leverage these technologies, the location analytics market is likely to witness a corresponding rise in demand for innovative solutions that facilitate deeper insights and improved decision-making.

Government Initiatives and Investments

Government initiatives in the GCC are playing a pivotal role in propelling the location analytics market forward. Various national strategies emphasize the importance of data-driven decision-making and smart infrastructure development. For example, the UAE Vision 2021 aims to enhance the quality of life through innovative technologies, including location-based services. Investments in smart city projects are also on the rise, with governments allocating substantial budgets to integrate location analytics into urban planning and management. This trend is expected to contribute to a projected market growth of around 20% in the coming years, as public sector entities increasingly adopt location analytics solutions to improve service delivery and resource allocation. Consequently, the location analytics market is likely to benefit from these strategic investments and initiatives.

Rising Demand for Geospatial Intelligence

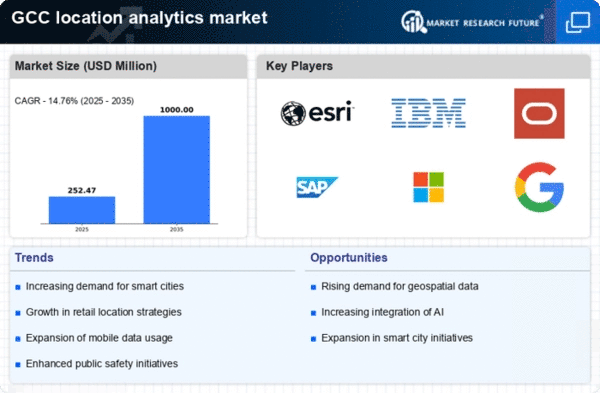

The location analytics market is experiencing a notable surge in demand for geospatial intelligence across various sectors in the GCC. Organizations are increasingly recognizing the value of spatial data in enhancing decision-making processes. For instance, the retail sector is leveraging location analytics to optimize store placements and improve customer targeting. According to recent estimates, the market for geospatial analytics in the GCC is projected to grow at a CAGR of approximately 15% from 2025 to 2030. This growth is driven by the need for businesses to gain insights into consumer behavior and market trends, thereby enhancing operational efficiency. As a result, the location analytics market is becoming an essential tool for organizations aiming to maintain a competitive edge in a rapidly evolving landscape.

Growing Focus on Customer Experience Enhancement

Enhancing customer experience is becoming a central focus for businesses in the GCC, driving the growth of the location analytics market. Companies are leveraging location-based insights to tailor their offerings and improve customer engagement. For instance, the hospitality sector is utilizing location analytics to personalize services and optimize marketing strategies. This trend is supported by research indicating that businesses that effectively utilize location data can increase customer satisfaction by up to 30%. As organizations strive to create more personalized experiences, the demand for location analytics solutions is expected to rise, potentially leading to a market growth rate of around 12% over the next few years. This focus on customer-centric strategies underscores the critical role of the location analytics market in shaping business operations.