Advancements in Mobile Technology

The location analytics market is being propelled by advancements in mobile technology. These advancements enable businesses to collect and analyze location data more effectively. With the proliferation of smartphones and mobile applications, organizations can access real-time location information, allowing for more precise targeting and personalized customer experiences. This trend is particularly relevant in industries such as hospitality and transportation, where location-based services are becoming increasingly vital. The mobile analytics market is projected to grow at a CAGR of over 20% through 2026, suggesting that the integration of mobile technology with location analytics will continue to enhance operational capabilities and customer engagement.

Expansion of Smart City Initiatives

The location analytics market is significantly influenced by the expansion of smart city initiatives across the United States. As urban areas increasingly adopt technology to improve infrastructure and services, the demand for location analytics solutions is expected to rise. Smart city projects often rely on location data to enhance traffic management, public safety, and resource allocation. For instance, cities are utilizing location analytics to analyze traffic patterns and optimize public transportation routes, thereby improving overall urban mobility. The investment in smart city technologies is projected to exceed $1 trillion by 2025, indicating a robust opportunity for the location analytics market to support these transformative urban developments.

Growth of E-commerce and Retail Analytics

The location analytics market is poised for growth due to the rapid expansion of e-commerce. The increasing importance of retail analytics is also a contributing factor. As online shopping continues to gain traction, retailers are leveraging location data to enhance their supply chain management and customer targeting strategies. By analyzing consumer behavior and preferences based on geographic data, businesses can optimize inventory distribution and improve marketing efforts. Reports suggest that the e-commerce sector in the US is expected to surpass $1 trillion in sales by 2025, which could drive further investment in location analytics solutions to support data-driven decision-making in retail.

Rising Demand for Geospatial Intelligence

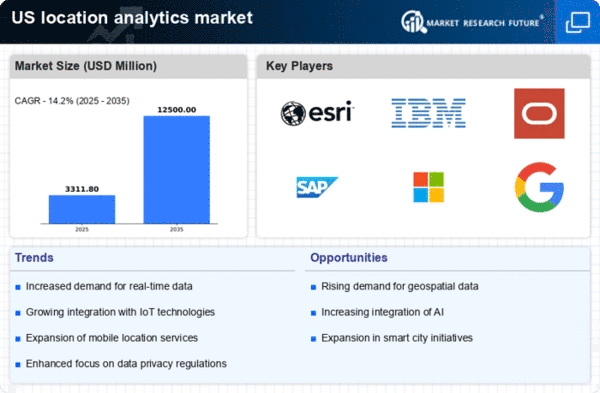

The location analytics market is experiencing a notable surge in demand for geospatial intelligence, driven by the need for businesses to make informed decisions based on location data. Companies across various sectors, including retail, logistics, and urban planning, are increasingly leveraging geospatial insights to optimize operations and enhance customer experiences. According to recent estimates, the market for geospatial analytics is projected to reach approximately $100 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 15%. This growth is indicative of the critical role that location analytics plays in strategic planning and operational efficiency, as organizations seek to harness the power of location-based data to gain a competitive edge in their respective industries.

Increased Focus on Data-Driven Decision Making

The location analytics market is benefiting from an increased focus on data-driven decision making. This trend is particularly evident among organizations in the United States. As businesses recognize the value of leveraging data to inform strategies, the demand for location analytics solutions is likely to rise. Companies are utilizing location data to identify market trends, optimize resource allocation, and enhance customer engagement. This shift towards data-centric approaches is evident in various sectors, including healthcare, finance, and transportation. The market for business intelligence and analytics is expected to reach $200 billion by 2026, indicating a strong correlation between data-driven decision making and the growth of the location analytics market.