Expansion of 5G Networks

The rollout of 5G networks across the GCC is set to revolutionize the IoT Integration Market. With significantly higher data transfer speeds and lower latency, 5G technology enables a greater number of devices to connect simultaneously, enhancing the capabilities of IoT applications. This technological advancement is expected to facilitate the deployment of more sophisticated iot solutions, particularly in sectors such as healthcare, transportation, and manufacturing. Analysts predict that the 5G market in the region could reach $10 billion by 2025, which will likely drive the demand for iot integration services. As businesses and governments seek to capitalize on the benefits of 5G, the iot integration market will be crucial in ensuring seamless connectivity and interoperability among devices.

Emergence of Industry 4.0

The advent of Industry 4.0 is significantly influencing the IoT Integration Market in the GCC. This new industrial revolution emphasizes automation, data exchange, and smart manufacturing processes, which require advanced iot integration solutions. As industries adopt smart technologies, the need for real-time data analytics and machine-to-machine communication becomes critical. The GCC manufacturing sector is projected to grow at a CAGR of 10% through 2025, indicating a robust demand for iot integration services. Companies are increasingly investing in IoT technologies to enhance productivity, reduce operational costs, and improve supply chain management. Consequently, the iot integration market is likely to experience substantial growth as businesses strive to implement Industry 4.0 principles.

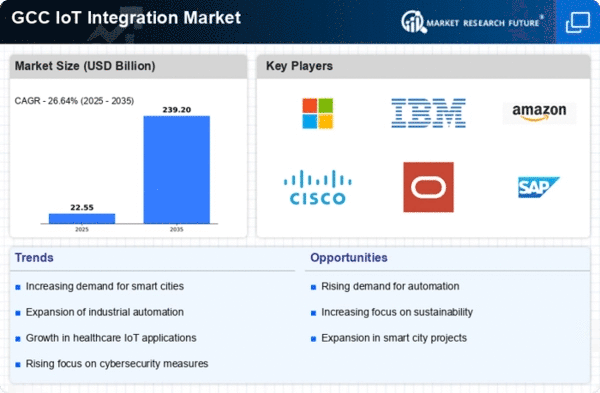

Rising Demand for Smart Cities

The increasing urbanization in the GCC region is driving the demand for smart city initiatives, which heavily rely on the IoT Integration Market. As cities expand, the need for efficient resource management, traffic control, and public safety becomes paramount. The GCC governments are investing significantly in smart infrastructure, with projections indicating that the smart city market could reach $20 billion by 2025. This trend necessitates robust iot integration solutions to connect various systems and devices, enhancing operational efficiency and improving the quality of life for residents. The iot integration market is thus positioned to benefit from this growing demand, as stakeholders seek to implement innovative technologies that facilitate seamless communication between devices and systems.

Growing Focus on Energy Efficiency

The GCC region is experiencing a heightened focus on energy efficiency, driven by both economic and environmental considerations. Governments are implementing policies aimed at reducing energy consumption and promoting sustainable practices, which directly impacts the IoT Integration Market. The integration of smart meters, energy management systems, and IoT devices is becoming essential for monitoring and optimizing energy usage. It is estimated that the energy management market in the GCC could grow by over 15% annually, creating a significant opportunity for iot integration solutions. By enabling real-time data collection and analysis, these solutions help organizations and consumers make informed decisions about energy consumption, thereby contributing to overall sustainability goals.

Increased Investment in Digital Transformation

Organizations across the GCC are increasingly prioritizing digital transformation, which is a key driver for the IoT Integration Market. Companies are recognizing the need to modernize their operations to remain competitive in a rapidly evolving landscape. According to recent estimates, the digital transformation spending in the region is expected to exceed $30 billion by 2025. This surge in investment is likely to create a substantial demand for iot integration solutions, as businesses seek to leverage data analytics, automation, and connectivity to enhance their operational capabilities. The iot integration market is thus poised to play a crucial role in facilitating this transformation, enabling organizations to harness the full potential of their digital initiatives.