Rising Demand for Automation

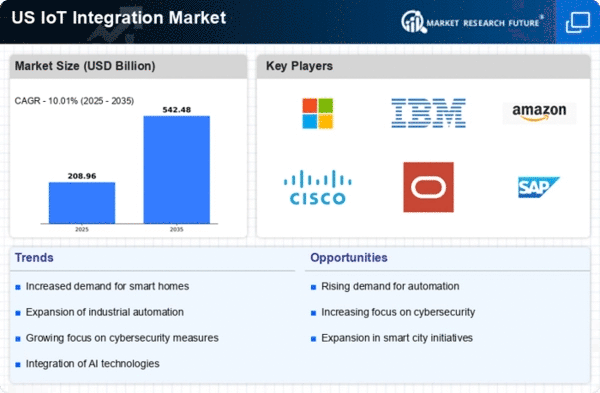

The increasing demand for automation across various sectors is a primary driver of the IoT Integration Market. Businesses are seeking to enhance operational efficiency and reduce human error through automated processes. In the manufacturing sector, for instance, the integration of IoT devices has been shown to improve productivity by up to 30%. This trend is not limited to manufacturing; sectors such as healthcare and logistics are also adopting IoT solutions to streamline operations. As organizations recognize the potential cost savings and efficiency gains, the iot integration market is expected to experience substantial growth, with projections indicating a compound annual growth rate (CAGR) of over 25% in the coming years.

Growing Emphasis on Data Analytics

The growing emphasis on data analytics is driving the IoT Integration Market as organizations seek to leverage the vast amounts of data generated by IoT devices. By integrating IoT systems with advanced analytics tools, businesses can gain valuable insights into operational performance and customer behavior. This capability is particularly relevant in sectors like retail, where data-driven decisions can enhance customer experiences and optimize inventory management. The market for IoT analytics is projected to reach approximately $20 billion by 2026, indicating a robust demand for integrated solutions that facilitate data analysis. Consequently, the integration of IoT with analytics platforms is likely to be a key focus area for companies looking to enhance their competitive edge.

Regulatory Support for IoT Initiatives

Regulatory support for IoT initiatives is emerging as a significant driver of the IoT Integration Market. Governments are increasingly recognizing the potential of IoT technologies to improve public services and enhance economic growth. Initiatives aimed at fostering smart city developments and enhancing infrastructure are being implemented across various states. For instance, federal funding for IoT projects has been allocated to improve transportation systems and energy efficiency. This regulatory backing not only encourages investment in IoT solutions but also creates a conducive environment for innovation. As policies evolve to support IoT integration, the market is likely to witness accelerated growth, with an estimated increase in investment by over 15% annually.

Advancements in Connectivity Technologies

The rapid advancements in connectivity technologies, such as 5G and LPWAN, are significantly influencing the IoT Integration Market. These technologies enable faster data transmission and improved network reliability, which are crucial for the effective functioning of IoT devices. For example, 5G networks can support up to 1 million devices per square kilometer, facilitating the deployment of smart applications in urban environments. As connectivity improves, businesses are more inclined to invest in IoT solutions, leading to an expansion of the iot integration market. The anticipated growth in 5G infrastructure is expected to further accelerate this trend, potentially increasing market value by billions of dollars over the next few years.

Increased Consumer Awareness and Adoption

Increased consumer awareness regarding the benefits of IoT technologies is driving the IoT Integration Market. As individuals become more familiar with smart home devices and connected technologies, there is a growing demand for integrated solutions that enhance convenience and security. The smart home market alone is projected to reach $174 billion by 2025, reflecting a shift in consumer preferences towards IoT-enabled products. This trend is prompting manufacturers to invest in IoT integration to meet consumer expectations. Furthermore, as more households adopt smart devices, the need for seamless integration across platforms becomes critical, thereby propelling the growth of the iot integration market.