Emergence of EdTech Startups

The rise of EdTech startups in the GCC is reshaping the landscape of the digital identity-in-education market. These innovative companies are developing cutting-edge solutions that address various challenges faced by educational institutions, including identity verification and data management. The influx of venture capital into the EdTech sector has led to the emergence of numerous startups focused on creating user-friendly digital identity platforms. As of 2025, it is estimated that investment in EdTech startups in the GCC has surpassed $500 million, indicating a robust interest in this market segment. This influx of new players is fostering competition and driving technological advancements, which may lead to more efficient and effective digital identity solutions in education.

Increased Mobile Device Usage

The proliferation of mobile devices among students and educators is significantly influencing the digital identity-in-education market. With a growing number of learners accessing educational resources via smartphones and tablets, there is an urgent need for robust digital identity solutions that can seamlessly integrate with mobile platforms. This trend is particularly pronounced in the GCC, where mobile penetration rates are among the highest globally. As of 2025, mobile device usage in educational settings is projected to account for over 60% of all digital interactions. Consequently, educational institutions are compelled to adopt mobile-friendly identity management systems that ensure secure access to learning materials and personal information. This shift towards mobile accessibility is likely to enhance user experience and engagement, thereby propelling the digital identity-in-education market.

Government Initiatives and Funding

Government initiatives play a crucial role in shaping the digital identity-in-education market within the GCC. Various governments are investing in digital transformation projects aimed at enhancing educational infrastructure. For instance, funding programs are being established to support the implementation of digital identity solutions in schools and universities. These initiatives are often aligned with national strategies to improve educational outcomes and promote innovation. Reports indicate that government spending on educational technology in the GCC is expected to reach approximately $1 billion by 2026. Such financial backing not only facilitates the adoption of digital identity solutions but also encourages collaboration between public and private sectors, ultimately driving growth in the digital identity-in-education market.

Rising Demand for Secure Authentication

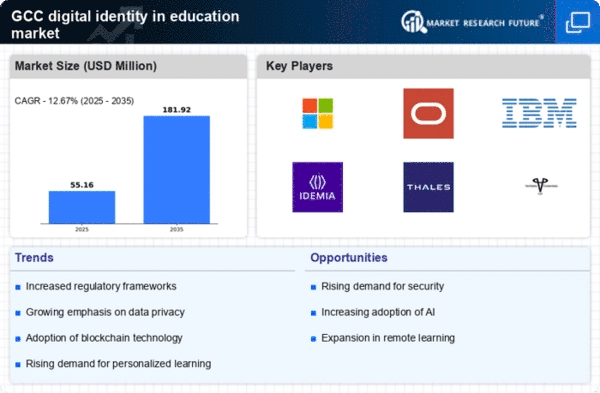

The digital identity-in-education market is experiencing a notable increase in demand for secure authentication methods. Educational institutions in the GCC are prioritizing the protection of student data and academic records. This trend is driven by the need to comply with stringent data protection regulations, which have become more prevalent in recent years. As a result, the market for secure authentication solutions is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of around 15% over the next five years. Institutions are increasingly adopting multi-factor authentication and blockchain technologies to enhance security, thereby fostering trust among students and parents. This heightened focus on secure authentication is likely to propel the digital identity-in-education market forward, as stakeholders seek to mitigate risks associated with data breaches and identity theft.

Growing Awareness of Cybersecurity Risks

There is a growing awareness of cybersecurity risks associated with digital identity management in the education sector. Educational institutions in the GCC are increasingly recognizing the potential threats posed by cyberattacks and data breaches. This heightened awareness is prompting schools and universities to invest in comprehensive cybersecurity measures, including advanced digital identity solutions. Reports suggest that educational institutions are allocating up to 10% of their IT budgets to cybersecurity initiatives, reflecting a proactive approach to safeguarding sensitive information. As institutions prioritize the protection of student data, the digital identity-in-education market is likely to expand, driven by the demand for solutions that offer enhanced security and resilience against cyber threats.