Rising Demand for Food Security

Food security remains a pressing concern in the GCC, where reliance on food imports is high. The connected agriculture market is poised to address this challenge by enhancing local food production capabilities. With the population in the GCC expected to reach 60 million by 2030, the demand for locally sourced food is increasing. This has led to a growing interest in smart farming solutions that can improve crop yields and reduce dependency on imports. The market for connected agriculture solutions is anticipated to grow at a CAGR of 12% through 2027, reflecting the urgency to bolster food security. By leveraging technology, farmers can better manage resources and respond to market demands, thereby contributing to a more resilient agricultural sector.

Government Initiatives and Policies

Government initiatives in the GCC are playing a crucial role in shaping the connected agriculture market. Various national strategies aim to enhance agricultural productivity and sustainability. For example, the UAE's National Food Security Strategy emphasizes the adoption of innovative agricultural technologies. Investments in research and development are also on the rise, with the government allocating approximately $100 million to support agricultural innovation. These initiatives not only foster a conducive environment for the connected agriculture market but also encourage private sector participation. As policies evolve to support technological integration, the market is likely to witness increased investment and growth, further driving the adoption of smart farming practices.

Climate Change and Environmental Concerns

The impact of climate change is increasingly felt in the GCC, prompting a shift towards more sustainable agricultural practices. The connected agriculture market is responding to these environmental challenges by offering solutions that promote resource efficiency. Technologies such as precision irrigation and climate-smart agriculture are gaining traction as farmers seek to mitigate the effects of climate variability. Reports indicate that water scarcity in the region could affect up to 60% of agricultural output by 2030, underscoring the need for innovative solutions. By adopting connected agriculture technologies, farmers can enhance resilience against climate impacts, thereby ensuring sustainable food production in the face of environmental uncertainties.

Technological Advancements in Agriculture

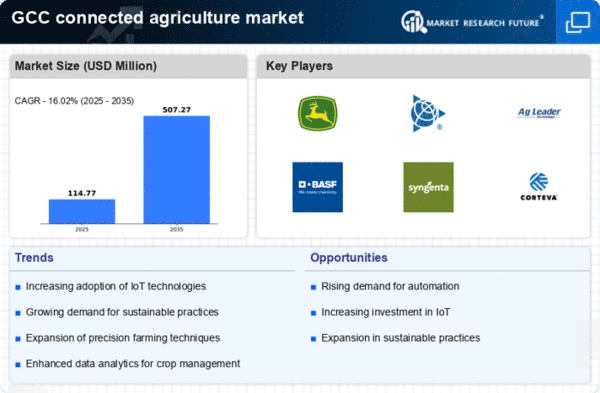

The connected agriculture market is experiencing a surge due to rapid technological advancements. Innovations in IoT, AI, and big data analytics are transforming traditional farming practices. In the GCC, the integration of smart sensors and automated systems is enhancing crop monitoring and resource management. For instance, The market for precision agriculture technologies is projected to reach $1.5 billion by 2026, which indicates a robust growth trajectory. These technologies enable farmers to optimize yields while minimizing resource wastage, thus aligning with the region's goals for sustainable food production. As farmers increasingly adopt these technologies, the connected agriculture market is likely to expand significantly, driven by the need for efficiency and productivity in agricultural operations.

Consumer Awareness and Demand for Transparency

There is a growing consumer awareness regarding food quality and sourcing in the GCC, which is influencing the connected agriculture market. Consumers are increasingly demanding transparency in food production processes, leading to a rise in interest for traceability solutions. Technologies that enable real-time monitoring of agricultural practices are becoming essential for producers aiming to meet consumer expectations. The market for food traceability solutions is projected to grow by 15% annually, reflecting this trend. As consumers seek assurance about the origins and safety of their food, the connected agriculture market is likely to expand, driven by the need for transparency and accountability in agricultural supply chains.