Focus on Patient-Centric Solutions

The shift towards patient-centric solutions is significantly influencing the Gastrointestinal GI Stent Market. Healthcare providers are increasingly prioritizing patient comfort and satisfaction, leading to the development of stents that are easier to implant and remove. This focus on user-friendly designs is likely to enhance patient compliance and overall treatment success. Additionally, the incorporation of patient feedback into the design process is fostering innovation, resulting in stents that better meet the needs of individuals suffering from gastrointestinal disorders. As a consequence, the market is expected to expand as more patients opt for stenting procedures that align with their preferences. The emphasis on patient-centric solutions is not only improving clinical outcomes but also driving the growth of the Gastrointestinal GI Stent Market, as stakeholders recognize the importance of addressing patient needs in their offerings.

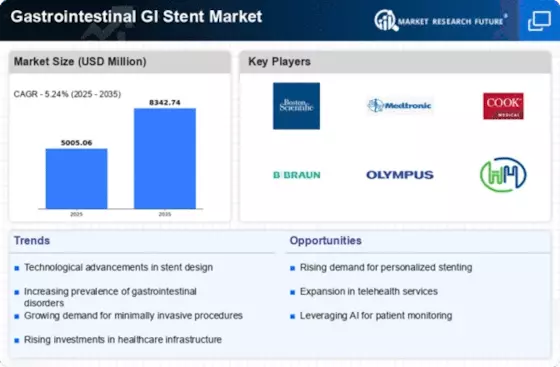

Technological Advancements in Stent Design

The Gastrointestinal GI Stent Market is experiencing a notable transformation due to rapid technological advancements in stent design. Innovations such as biodegradable stents and drug-eluting stents are gaining traction, enhancing patient outcomes and reducing complications. These advancements are likely to improve the efficacy of stents in treating various gastrointestinal conditions, thereby increasing their adoption. The market is projected to witness a compound annual growth rate (CAGR) of approximately 6% over the next few years, driven by these technological improvements. Furthermore, the integration of minimally invasive techniques in stent placement is expected to reduce recovery times and hospital stays, making stents a more appealing option for both patients and healthcare providers. As a result, the Gastrointestinal GI Stent Market is poised for significant growth, reflecting the ongoing commitment to enhancing patient care through innovation.

Rising Incidence of Gastrointestinal Disorders

The prevalence of gastrointestinal disorders is on the rise, which is a critical driver for the Gastrointestinal GI Stent Market. Conditions such as colorectal cancer, esophageal strictures, and biliary obstructions are becoming increasingly common, necessitating effective treatment options. According to recent estimates, the incidence of colorectal cancer alone is projected to increase by 2% annually, leading to a higher demand for stenting procedures. This trend is further exacerbated by lifestyle factors such as poor diet and sedentary behavior, which contribute to gastrointestinal health issues. As healthcare systems strive to address these challenges, the demand for gastrointestinal stents is expected to surge, thereby propelling the market forward. The Gastrointestinal GI Stent Market must adapt to these changing dynamics to meet the growing needs of patients and healthcare providers alike.

Aging Population and Associated Health Challenges

The aging population presents a significant driver for the Gastrointestinal GI Stent Market. As individuals age, they are more susceptible to various gastrointestinal disorders, including strictures and obstructions. The demographic shift towards an older population is likely to increase the demand for gastrointestinal stenting procedures, as older adults often require more complex medical interventions. Projections indicate that by 2030, the number of individuals aged 65 and older will surpass 1 billion, creating a substantial market for gastrointestinal stents. This demographic trend underscores the necessity for healthcare providers to adapt their services to cater to the unique needs of older patients. Consequently, the Gastrointestinal GI Stent Market is expected to grow in response to the increasing prevalence of gastrointestinal issues among the aging population, highlighting the importance of targeted solutions for this demographic.

Increasing Investment in Healthcare Infrastructure

Investment in healthcare infrastructure is a pivotal driver for the Gastrointestinal GI Stent Market. Governments and private entities are allocating substantial resources to enhance healthcare facilities, particularly in emerging economies. This investment is likely to improve access to advanced medical technologies, including gastrointestinal stents, thereby expanding the market. For instance, the establishment of specialized gastrointestinal treatment centers is expected to facilitate the adoption of stenting procedures, as these centers are equipped with the latest technology and skilled professionals. Furthermore, as healthcare systems evolve, the demand for minimally invasive procedures is anticipated to rise, further propelling the Gastrointestinal GI Stent Market. The ongoing commitment to improving healthcare infrastructure is crucial for meeting the growing needs of patients and ensuring the availability of effective treatment options.