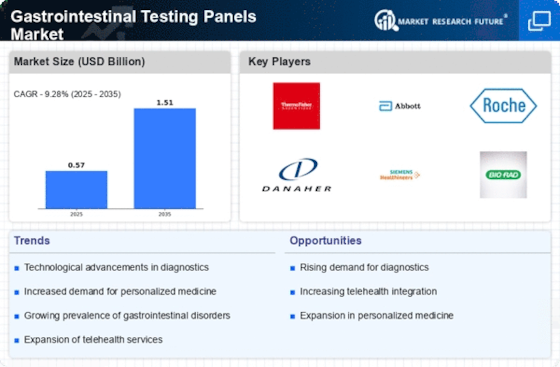

Rising Healthcare Expenditure

The upward trend in healthcare expenditure is likely to serve as a significant driver for the Gastrointestinal Testing Panels Market. As countries allocate more resources to healthcare, there is an increasing investment in diagnostic services, including gastrointestinal testing. This rise in expenditure is associated with a growing recognition of the value of accurate diagnostics in improving patient outcomes and reducing long-term healthcare costs. Market data indicates that healthcare spending is projected to continue its upward trajectory, which may lead to enhanced funding for gastrointestinal testing initiatives. Consequently, the increased healthcare expenditure is expected to create a favorable environment for the growth of the Gastrointestinal Testing Panels Market, as stakeholders seek to capitalize on the demand for advanced diagnostic solutions.

Advancements in Diagnostic Technologies

Technological innovations in diagnostic methodologies are significantly influencing the Gastrointestinal Testing Panels Market. The introduction of advanced testing techniques, such as next-generation sequencing and multiplex PCR, has enhanced the accuracy and efficiency of gastrointestinal diagnostics. These technologies enable the simultaneous detection of multiple pathogens and biomarkers, thereby streamlining the diagnostic process. Market data indicates that the adoption of these advanced technologies is on the rise, as healthcare facilities aim to improve patient outcomes through more precise testing. Additionally, the integration of artificial intelligence and machine learning in diagnostic tools is expected to further refine the capabilities of gastrointestinal testing panels. Consequently, the ongoing advancements in diagnostic technologies are likely to serve as a catalyst for growth within the Gastrointestinal Testing Panels Market.

Growing Demand for Preventive Healthcare

The increasing emphasis on preventive healthcare is emerging as a significant driver for the Gastrointestinal Testing Panels Market. As healthcare systems worldwide shift towards preventive measures, there is a growing recognition of the importance of early detection and intervention in gastrointestinal diseases. This trend is reflected in the rising utilization of screening tests and diagnostic panels aimed at identifying potential gastrointestinal issues before they escalate. Market data suggests that the preventive healthcare segment is expanding, with more individuals opting for routine gastrointestinal testing as part of their health maintenance. This proactive approach not only aids in early diagnosis but also reduces the overall healthcare burden. Therefore, the growing demand for preventive healthcare is likely to bolster the Gastrointestinal Testing Panels Market in the coming years.

Regulatory Support for Diagnostic Innovations

Regulatory bodies are increasingly supporting innovations in diagnostic testing, which is positively impacting the Gastrointestinal Testing Panels Market. Initiatives aimed at expediting the approval process for new diagnostic tests and technologies are fostering an environment conducive to market growth. For instance, regulatory agencies are implementing frameworks that facilitate the rapid introduction of novel gastrointestinal testing panels, thereby enhancing patient access to advanced diagnostic solutions. This regulatory support is crucial, as it encourages research and development efforts within the industry, leading to the emergence of more effective testing options. As a result, the favorable regulatory landscape is expected to drive the expansion of the Gastrointestinal Testing Panels Market, as companies are motivated to innovate and bring new products to market.

Increasing Prevalence of Gastrointestinal Disorders

The rising incidence of gastrointestinal disorders, such as irritable bowel syndrome, inflammatory bowel disease, and gastrointestinal infections, appears to be a primary driver for the Gastrointestinal Testing Panels Market. According to recent data, the prevalence of these conditions has been steadily increasing, leading to a heightened demand for effective diagnostic solutions. This trend is likely to propel the market forward, as healthcare providers seek to implement comprehensive testing panels that can accurately identify and manage these disorders. Furthermore, the growing awareness among patients regarding gastrointestinal health is expected to contribute to the market's expansion, as individuals become more proactive in seeking diagnostic testing. As a result, the Gastrointestinal Testing Panels Market is poised for significant growth in response to these evolving healthcare needs.