Emerging Markets and Urbanization

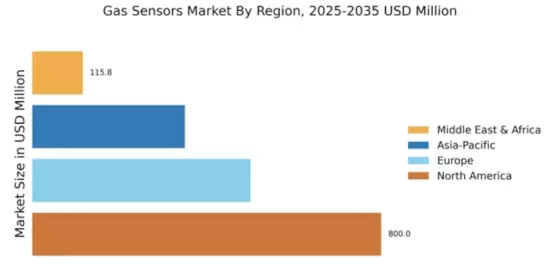

The Global Gas Sensor Market Industry is benefiting from the rapid urbanization and industrialization occurring in emerging markets. As cities expand and industries proliferate, the demand for gas sensors to monitor air quality and ensure safety is increasing. Countries in Asia-Pacific and Latin America are witnessing significant investments in infrastructure and industrial projects, which necessitate the deployment of gas detection systems. This trend is likely to drive market growth, as urban areas face challenges related to air pollution and safety. The anticipated compound annual growth rate of 8.22% from 2025 to 2035 underscores the potential for expansion in these regions.

Growth in Industrial Applications

The Global Gas Sensor Market Industry is experiencing notable growth due to the increasing adoption of gas sensors in industrial applications. Industries such as petrochemicals, pharmaceuticals, and food processing are utilizing gas sensors for monitoring and controlling processes. This trend is driven by the need for compliance with safety standards and the desire to optimize operational efficiency. For instance, gas sensors are employed to detect leaks in pipelines and storage tanks, thereby preventing potential hazards. The market is projected to expand significantly, with estimates suggesting a market value of 4.08 USD Billion by 2035, reflecting the growing reliance on gas detection technologies in industrial settings.

Increasing Environmental Regulations

The Global Gas Sensor Market Industry is experiencing growth due to stringent environmental regulations aimed at reducing air pollution and ensuring safety in industrial operations. Governments worldwide are implementing laws that mandate the use of gas sensors in various sectors, including manufacturing, oil and gas, and automotive. For instance, the European Union has established regulations that require continuous monitoring of hazardous gases, which drives demand for advanced gas sensing technologies. This regulatory landscape is expected to contribute to the market's expansion, with projections indicating a market value of 1.71 USD Billion in 2024, potentially reaching 4.08 USD Billion by 2035.

Rising Demand for Safety and Security

The Global Gas Sensor Market Industry is significantly influenced by the increasing demand for safety and security measures across various sectors. Industries such as oil and gas, chemical manufacturing, and mining are particularly vulnerable to gas leaks, which can lead to catastrophic incidents. As a result, companies are investing in gas detection systems to ensure the safety of their employees and the surrounding environment. This trend is further supported by the growing awareness of workplace safety regulations. The market is likely to see a compound annual growth rate of 8.22% from 2025 to 2035, reflecting the heightened focus on safety protocols.

Technological Advancements in Sensor Technology

Technological advancements are playing a pivotal role in the evolution of the Global Gas Sensor Market Industry. Innovations in sensor technology, such as the development of miniaturized sensors and enhanced sensitivity, are enabling more accurate and reliable gas detection. These advancements facilitate the integration of gas sensors into smart devices and IoT applications, thereby expanding their applicability across various sectors. For example, the integration of gas sensors in smart homes allows for real-time monitoring of indoor air quality. As these technologies continue to evolve, they are expected to drive market growth, contributing to the anticipated market value of 1.71 USD Billion in 2024.