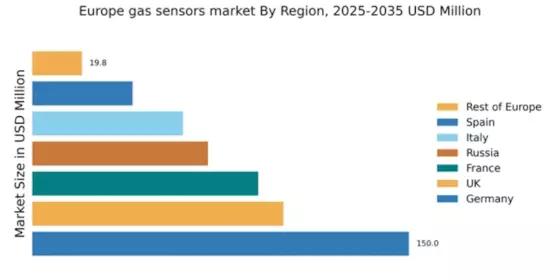

Germany : Strong industrial base drives growth

Key markets include industrial hubs like North Rhine-Westphalia and Bavaria, where major manufacturing and chemical industries thrive. The competitive landscape features prominent players such as Drägerwerk and Honeywell, which have established strong local presences. The business environment is characterized by innovation and collaboration between industry and research institutions. Applications span various sectors, including manufacturing, healthcare, and environmental monitoring.

UK : Safety regulations fuel market demand

Key markets include London, Manchester, and Aberdeen, where industrial activities are concentrated. The competitive landscape features major players like MSA Safety and Honeywell, which are well-positioned to meet local demand. The business environment is dynamic, with a focus on innovation and sustainability. Applications are diverse, ranging from industrial safety to smart building technologies, reflecting the evolving needs of the market.

France : Innovation drives sector growth

Key markets include Île-de-France and Auvergne-Rhône-Alpes, where industrial and automotive sectors are prominent. The competitive landscape features players like Emerson Electric and Sensirion, which are expanding their offerings to meet local needs. The business environment is characterized by a strong emphasis on R&D and collaboration with local universities. Applications range from automotive emissions monitoring to industrial safety, reflecting the diverse needs of the market.

Russia : Industrial expansion boosts market potential

Key markets include Moscow and Siberia, where significant industrial activities are concentrated. The competitive landscape features local and international players, including GfG Instrumentation and Honeywell, which are adapting to local market conditions. The business environment is evolving, with a focus on enhancing safety standards and technological advancements. Applications are diverse, spanning industrial safety, environmental monitoring, and energy production.

Italy : Manufacturing sector drives demand

Key markets include Lombardy and Emilia-Romagna, where industrial activities are concentrated. The competitive landscape features players like Drägerwerk and Ametek, which have established strong local presences. The business environment is characterized by innovation and collaboration between industry and academia. Applications range from automotive safety to industrial emissions monitoring, reflecting the diverse needs of the market.

Spain : Regulatory changes spur demand

Key markets include Catalonia and Madrid, where industrial and construction activities are concentrated. The competitive landscape features players like Honeywell and RKI Instruments, which are expanding their offerings to meet local demand. The business environment is dynamic, with a focus on innovation and sustainability. Applications range from construction safety to energy production, reflecting the evolving needs of the market.

Rest of Europe : Varied applications across sectors

Key markets include Eastern European countries where industrial activities are growing. The competitive landscape features a mix of local and international players, adapting to regional needs. The business environment is characterized by varying levels of regulatory compliance and market maturity. Applications are diverse, ranging from agricultural safety to healthcare monitoring, reflecting the unique needs of each sub-region.