Regulatory Support for Sustainable Energy

The Gas-Insulated Transmission Line Market is bolstered by increasing regulatory support for sustainable energy initiatives. Governments worldwide are implementing policies aimed at reducing carbon emissions and promoting renewable energy sources. This regulatory environment encourages the adoption of gas-insulated transmission lines, which facilitate the integration of renewable energy into existing grids. For instance, countries are setting ambitious targets for renewable energy generation, which necessitates the development of efficient transmission infrastructure. The market is likely to see a rise in investments as utilities seek to comply with these regulations, potentially leading to a market growth rate of around 7% in the coming years. This alignment with sustainability goals positions the gas-insulated transmission line sector favorably in the evolving energy landscape.

Urbanization and Infrastructure Development

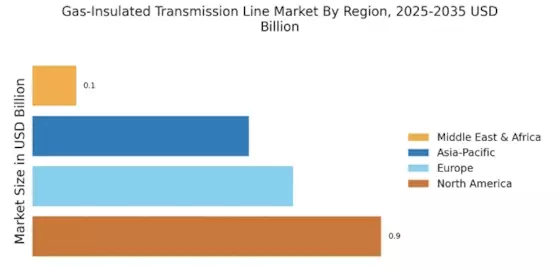

Rapid urbanization is a key driver for the Gas-Insulated Transmission Line Market, as cities expand and demand for reliable energy transmission increases. The need for efficient power distribution in densely populated areas necessitates the adoption of gas-insulated lines, which require less space and are less susceptible to environmental factors compared to traditional overhead lines. As urban infrastructure develops, the integration of gas-insulated transmission lines becomes essential for meeting energy demands while minimizing land use. This trend is particularly evident in emerging economies, where urban centers are growing at unprecedented rates. The market is expected to benefit from this urban expansion, with projections indicating a significant increase in installations over the next decade.

Rising Investment in Smart Grid Technologies

Investment in smart grid technologies is emerging as a crucial driver for the Gas-Insulated Transmission Line Market. As utilities seek to modernize their infrastructure, the integration of gas-insulated transmission lines with smart grid systems is becoming increasingly prevalent. These technologies enhance grid reliability, improve energy efficiency, and facilitate better management of energy resources. The market for smart grid solutions is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the next few years. This growth is likely to spur demand for gas-insulated lines, as they are well-suited for smart grid applications. The synergy between smart grid initiatives and gas-insulated transmission lines may redefine energy distribution and management practices in the near future.

Increased Demand for Renewable Energy Integration

The growing emphasis on renewable energy sources is a significant driver for the Gas-Insulated Transmission Line Market. As nations strive to transition from fossil fuels to cleaner energy alternatives, the need for efficient transmission systems becomes paramount. Gas-insulated transmission lines offer a viable solution for connecting renewable energy sources, such as wind and solar, to the grid. Their compact design and high reliability make them ideal for integrating distributed energy resources. Market analysts suggest that the demand for gas-insulated lines will rise in tandem with renewable energy capacity, which is expected to double by 2030. This trend indicates a robust future for the gas-insulated transmission line sector as it aligns with global energy transition goals.

Technological Advancements in Gas-Insulated Transmission Line Market

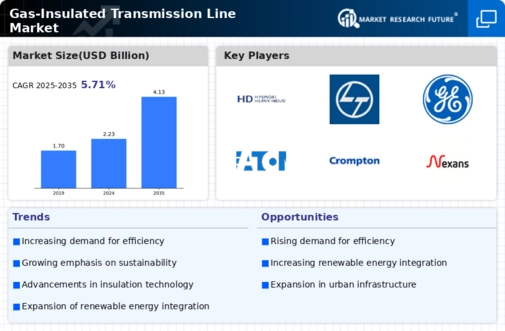

The Gas-Insulated Transmission Line Market is experiencing a surge in technological advancements that enhance efficiency and reliability. Innovations such as digital monitoring systems and improved insulation materials are being integrated into gas-insulated lines, which could potentially reduce maintenance costs and increase operational lifespan. The introduction of smart grid technologies is also transforming the landscape, allowing for real-time data analysis and improved fault detection. As a result, the market is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years, driven by these advancements. This trend indicates a shift towards more intelligent and responsive energy transmission systems, which may redefine operational standards in the industry.