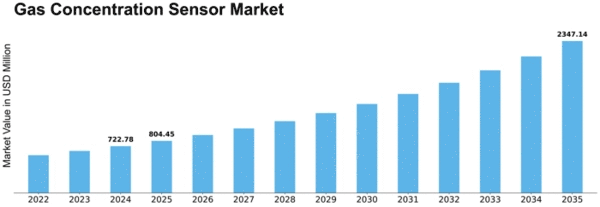

Gas Concentration Sensor Size

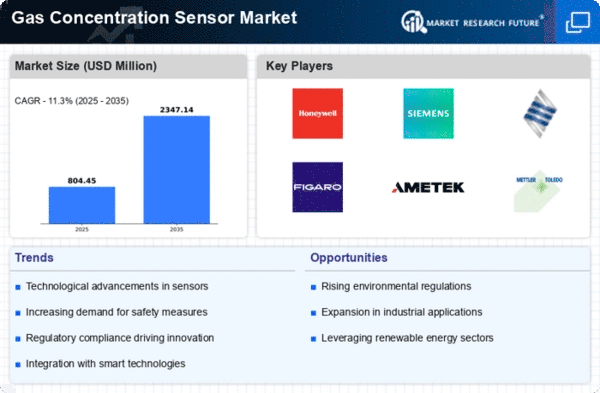

Gas Concentration Sensor Market Growth Projections and Opportunities

The GCS market has multiple factors that advancement the behaviour and nature of. The major critical factor that supports this market is a rise in the concern and awareness about air quality and safety issues across numerous sectors. Due to increasing concerns towards ecology-friendly nature and safety of work, gas concentration sensors’ demand has experienced high gradients. These sensors are very important for the detection and monitoring of the concentrations of different gases, make it possible to respond instantly even before people may notice any danger itself and maintain safety in this way. Government regulations and standards with respect to air quality and occupational safety in addition make it propagate the use of gas concentration sensors, which ultimately add up to a favorable market environment. Another important impetus of the Gas Concentration Sensor market is also technological innovations. Developments that are continuing Sensor technologies result in some advances of concentration sensors’ performance after improved sensitivity, the selectivity and response time to changes. Also, embedded intelligence through IoT unit capabilities and wireless communication functionality to provide real-time monitoring of sensor data as well as the access to this information in a remote manner. The technology innovations are contributing factors that make gas concentration sensors no longer restrictive, but efficient and user-friendly engines for many industries such as manufacturing and petrochemical, health care service and environmental observations etc. Industry requirements mostly steer the Gas Concentration Sensor Market movements. Gas detection, as a concept, greatly varies significantly when considering different sectors like oil and gas industry, chemical manufacturing, or indoor air quality management. For instance, in industrial environments, combustible gas sensing devices are paramount to accident prevention while the same cannot be downplayed for sensors that monitor indoor air quality in healthcare institutions for maintaining safe and clean environment by preventing excessive exposure of patients or staff members to chemicals. The cell phone manufacturers for GCS market must have to comprehend such diverse needs and provide customized solutions that fit into industry necessities. Demand being influenced by economic factors has a big input towards the development of the Gas Concentration Sensor market. Economic development, industrialization and infrastructure projects spurring the consumption of gas concentration sensors in countries vying to be on par with the other developed nations. The development and growth of industries with accompaniment by urbanization has led to evolve a great need for measures due to safety that further makes the gas concentration sensors as adopted. On the other hand, economic recessions can affect occasionally on market activity since firms must focus on cost-saving actions when times are tough.

Leave a Comment