Market Analysis

In-depth Analysis of Gas Concentration Sensor Market Industry Landscape

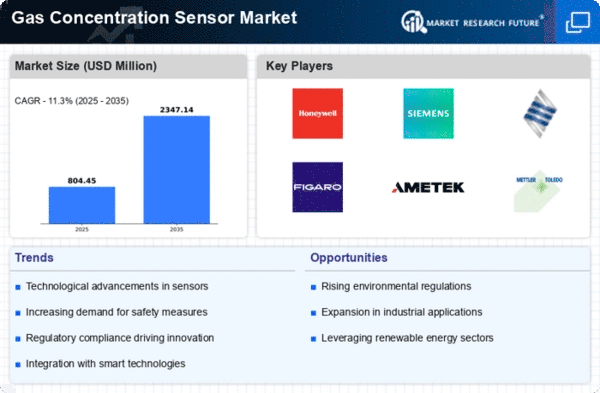

The global gas concentration sensor market is set to reach US$ 1902.3 MN by 2032, at a 11.30% CAGR between years 2023-2032. Several factors shape the dynamics of the Gas Concentration Sensor Market, none of which operates as an isolated factor. The market responds to increased environmental concerns such as monitoring and industrial safety with measures such as smart technologies and remote controls in appliances. The role of gas concentration sensors in the detection and measurement percentages or levels of gases in different places which comprises both industrial setups to rooms within houses is very important. The awareness about the need for maintaining air quality as well as working environment in worldwide is one of the main factors contributing to the movement. Strict regulations being set up globally under pollution control guidelines by various governments and environmental oversight agencies across the world are introducing stringent norms, necessitating industries to adopt gas concentration sensors for the purpose of monitoring and controlling emissions ultimately contributing immensely to market development. The high demand for gas-concentration sensors is inversely proportional to the trade profile that applies them mainly for gas leak detection, process tracking, and worker surveillance. These sensors play an important role in the operations of industries like oil and gas, chemicals manufacturing and mining where there is heavy reliance on these sensors to ensure a safe working environment that will cause no harm complying with occupational safety regulation. The requirement for instant response and immediate monitoring of gas leakage boosts the demand for sophisticated technology that can sense the level of gas concentration speedily, thus enhancing innovation within the market. Finally, technologies such as IoT and smart cities play a big role in boosting the market trends of gas concentration sensors. Such sensors are mounted to create intelligible infrastructure that can give real-time sensing of air pollution and allow early warnings of the impending environmental risks. The blossoming of the connected devices and architecturally engineered sensor networks result in the unprecedented opportunities for gas concentration sensor producers to target a wide range of applications, like urban planning or intelligent transportation systems. The market is the known for the technologies evolved to improve gas concentration sensors in terms of accuracy, sensitivity, and reliability. There are new developments in the area of sensory technologies, such as the ones pertaining to optical gas sensing and electrochemical sensing that help encourage market growth. Moreover, miniaturization and cost barrier progressively determine the need for gas concentration sensors to reach a wider target market such as consumer electronics utilizations or indoor air quality surveillance, wearables among others. Current goals across the global community toward environmental sustainability and green technologies also affect the gas concentration sensor market. Industries have embraced more environmentally sound ways of doing things and engineering appropriate systems for control to limit the industry’s carbon footprint. Environmental control and measurement of emissions, one of the most important steps that ensure a smooth transition from fossil-based energy to renewable sources, is made possible through gas concentration sensors. As such it enables effective compliance with environmentally friendly objectives and legislation acting requirements.

Leave a Comment