Advancements in Photovoltaic Technologies

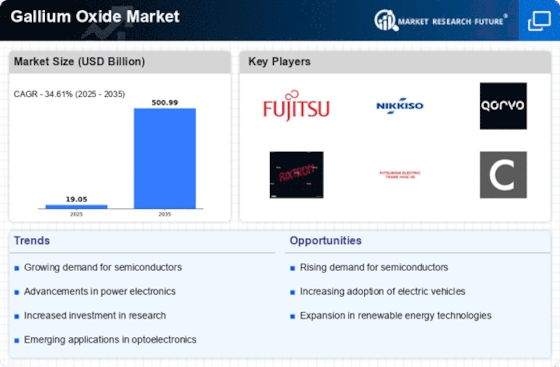

The Gallium Oxide Market is significantly influenced by advancements in photovoltaic technologies. As the world shifts towards renewable energy sources, the demand for efficient solar cells is escalating. Gallium oxide is being explored for its potential to improve the efficiency of solar panels, particularly in tandem with silicon-based technologies. Research indicates that gallium oxide can enhance light absorption and reduce energy losses, making it a promising candidate for next-generation solar cells. The Gallium Oxide Market is expected to grow at a CAGR of over 20% through 2025, which could lead to increased adoption of gallium oxide in photovoltaic applications. This trend underscores the potential of the Gallium Oxide Market in contributing to sustainable energy solutions.

Growing Focus on Energy-Efficient Solutions

The Gallium Oxide Market is benefiting from a growing focus on energy-efficient solutions across various sectors. As energy costs rise and environmental concerns mount, industries are increasingly seeking materials that can reduce energy consumption. Gallium oxide, known for its high efficiency in power conversion, is becoming a preferred choice for manufacturers aiming to enhance energy efficiency in their products. The energy-efficient electronics market is projected to reach USD 1.5 trillion by 2025, creating a substantial opportunity for gallium oxide applications. This trend is particularly evident in the automotive sector, where electric vehicles require advanced materials to optimize performance. The Gallium Oxide Market is thus well-positioned to capitalize on this shift towards sustainability.

Emerging Applications in Defense and Aerospace

The Gallium Oxide Market is witnessing emerging applications in the defense and aerospace sectors. The unique properties of gallium oxide, such as its high thermal stability and wide bandgap, make it suitable for high-frequency and high-power applications. As defense technologies advance, there is a growing need for materials that can withstand extreme conditions while maintaining performance. The aerospace sector, in particular, is exploring gallium oxide for use in satellite communications and radar systems. The Gallium Oxide Market is expected to exceed USD 2 trillion by 2025, indicating a significant opportunity for gallium oxide integration. This trend highlights the potential of the Gallium Oxide Market to support critical applications in national security and advanced aerospace technologies.

Rising Demand for High-Performance Electronics

The Gallium Oxide Market is experiencing a surge in demand due to the increasing need for high-performance electronic devices. As consumer electronics evolve, manufacturers are seeking materials that can enhance efficiency and performance. Gallium oxide, with its wide bandgap properties, is particularly suited for applications in power electronics and RF devices. The market for power electronics is projected to reach USD 1 trillion by 2025, indicating a substantial opportunity for gallium oxide. This demand is further fueled by the proliferation of electric vehicles and renewable energy systems, which require advanced semiconductor materials. Consequently, the Gallium Oxide Market is poised for growth as it aligns with the technological advancements in electronics.

Increased Investment in Research and Development

Investment in research and development is a critical driver for the Gallium Oxide Market. As industries recognize the unique properties of gallium oxide, funding for innovative applications is on the rise. Governments and private entities are allocating resources to explore its use in various sectors, including telecommunications, automotive, and aerospace. For instance, the semiconductor sector is projected to invest over USD 500 billion in R&D by 2025, with gallium oxide being a focal point due to its superior thermal and electrical properties. This influx of investment is likely to accelerate the commercialization of gallium oxide technologies, thereby expanding the market. The Gallium Oxide Market stands to benefit from these advancements, as new applications emerge.