Expansion in Automotive Applications

The Gallium Arsenide Market is witnessing expansion in automotive applications, particularly with the rise of electric vehicles (EVs). GaAs components are increasingly utilized in power electronics and battery management systems due to their efficiency and thermal performance. As the automotive sector shifts towards electrification, the demand for GaAs-based devices is anticipated to grow. Market forecasts suggest that the adoption of GaAs in automotive applications could lead to a significant increase in revenue for the industry, as manufacturers seek to enhance vehicle performance and energy efficiency. This trend indicates a promising future for the Gallium Arsenide Market, as it aligns with the broader movement towards sustainable transportation solutions.

Growing Demand in Telecommunications

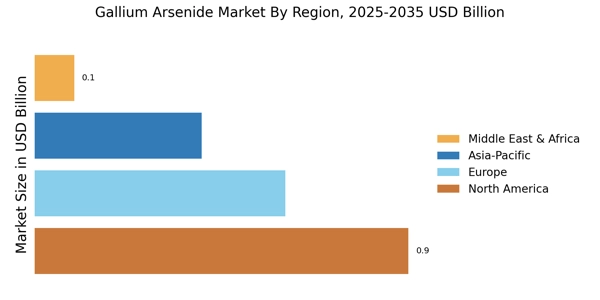

The Gallium Arsenide Market is significantly impacted by the growing demand in telecommunications. With the advent of 5G technology, the need for high-performance materials has escalated. Gallium arsenide is particularly well-suited for 5G applications due to its ability to operate at higher frequencies and its efficiency in power amplification. The telecommunications sector is projected to invest heavily in GaAs technology, with market analysts estimating a substantial increase in GaAs component sales over the next few years. This trend is likely to enhance the overall market landscape, as telecommunications companies seek to improve network performance and reliability. The integration of GaAs in next-generation communication devices is expected to be a key driver for the industry.

Technological Advancements in Electronics

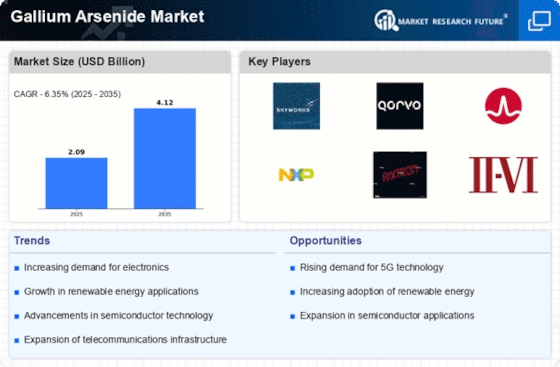

The Gallium Arsenide Market is experiencing a surge due to rapid technological advancements in electronics. Gallium arsenide (GaAs) is increasingly favored for its superior electron mobility and efficiency compared to silicon, particularly in high-frequency applications. The market for GaAs-based devices, such as RF amplifiers and optoelectronic components, is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years. This growth is driven by the demand for faster and more efficient electronic devices, including smartphones and satellite communications. As manufacturers continue to innovate and integrate GaAs into their products, the industry is likely to witness enhanced performance metrics, further solidifying its position in the electronics sector.

Rising Investment in Research and Development

The Gallium Arsenide Market is benefiting from rising investment in research and development (R&D). As companies and research institutions explore new applications for GaAs, the potential for innovation appears vast. Increased funding for R&D initiatives is likely to lead to breakthroughs in GaAs technology, enhancing its performance and expanding its applications across various sectors. This trend is particularly evident in the semiconductor industry, where GaAs is being explored for next-generation devices. Analysts predict that sustained investment in R&D will not only drive technological advancements but also create new market opportunities within the Gallium Arsenide Market, fostering a competitive landscape that encourages growth and development.

Sustainability and Environmental Considerations

The Gallium Arsenide Market is increasingly influenced by sustainability and environmental considerations. As industries strive to reduce their carbon footprint, the demand for energy-efficient materials has risen. Gallium arsenide, known for its high efficiency in converting solar energy, is becoming a preferred choice in photovoltaic applications. The market for GaAs solar cells is expected to expand, with projections indicating a potential increase in market share as more countries adopt renewable energy policies. Furthermore, the recycling of GaAs materials is gaining traction, which aligns with global sustainability goals. This focus on environmentally friendly practices is likely to drive innovation and investment in the Gallium Arsenide Market, fostering a more sustainable future.