Humanization of Pets

The trend of pet humanization significantly influences the Frozen Freeze-Dried Pet Foods Market. As pets are increasingly viewed as family members, owners are more inclined to invest in high-quality food that mirrors human dietary standards. This shift has led to a rise in demand for freeze-dried options, which are perceived as more natural and wholesome. Market analysis suggests that the humanization trend has contributed to a 20% increase in premium pet food sales, with freeze-dried products being at the forefront of this movement. This evolving perception of pets drives the growth of the Frozen Freeze-Dried Pet Foods Market.

Diverse Product Offerings

The expansion of diverse product offerings is a significant driver in the Frozen Freeze-Dried Pet Foods Market. As consumer preferences evolve, manufacturers are introducing a variety of flavors and formulations to cater to different dietary needs and preferences. This diversification not only attracts a broader customer base but also encourages repeat purchases. Recent data shows that the introduction of new freeze-dried products has led to a 25% increase in market penetration. This trend underscores the importance of variety in driving sales and growth within the Frozen Freeze-Dried Pet Foods Market.

Convenience and Shelf Stability

Convenience plays a crucial role in the Frozen Freeze-Dried Pet Foods Market. Busy lifestyles have led pet owners to seek easy-to-prepare meal options that do not compromise on quality. Freeze-dried foods offer extended shelf life and require minimal preparation, making them an attractive choice for consumers. Recent statistics indicate that the convenience factor has led to a 30% increase in sales of freeze-dried pet foods over the past year. This trend highlights the growing preference for products that combine quality with ease of use, thereby propelling the Frozen Freeze-Dried Pet Foods Market forward.

Sustainability and Ethical Sourcing

Sustainability concerns are increasingly shaping consumer choices in the Frozen Freeze-Dried Pet Foods Market. Pet owners are becoming more aware of the environmental impact of their purchases and are seeking products that are ethically sourced and produced. Freeze-dried pet foods often utilize sustainable practices, appealing to eco-conscious consumers. Market Research Future indicates that approximately 40% of pet owners are willing to pay a premium for sustainably sourced products. This growing demand for ethical options is likely to drive innovation and growth within the Frozen Freeze-Dried Pet Foods Market.

Health Benefits of Freeze-Dried Foods

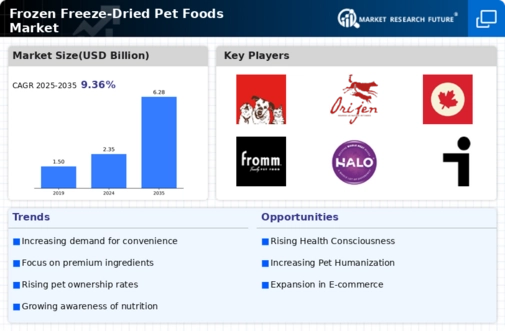

The increasing awareness of pet health and nutrition is a primary driver for the Frozen Freeze-Dried Pet Foods Market. Pet owners are increasingly seeking high-quality, nutritious options that promote overall well-being. Freeze-dried foods retain essential nutrients and enzymes, making them appealing to health-conscious consumers. According to recent data, the pet food market has seen a shift towards premium products, with freeze-dried options experiencing a notable growth rate of approximately 15% annually. This trend indicates a strong preference for products that offer health benefits, thereby driving demand in the Frozen Freeze-Dried Pet Foods Market.

Leave a Comment