Innovations in Food Technology

Technological advancements in food processing and preservation are propelling the Freeze-dried vegetable Powder Market forward. Innovations such as improved freeze-drying techniques enhance the quality and nutritional retention of vegetable powders, making them more appealing to consumers. These advancements not only improve the taste and texture of the final product but also extend shelf life, which is crucial for both consumers and manufacturers. The introduction of new flavors and blends, facilitated by these technologies, is likely to attract a broader customer base. In recent years, investments in food technology have increased, with the freeze-dried segment receiving a notable share, suggesting a promising future for the industry.

Convenience and Shelf Stability

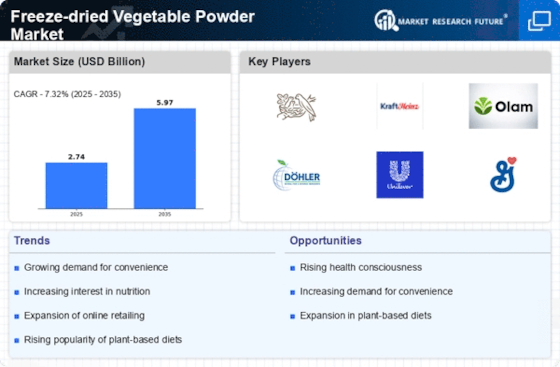

The demand for convenience in food preparation is a driving force in the Freeze-dried Vegetable Powder Market. Consumers increasingly seek products that require minimal preparation time while retaining nutritional value. Freeze-dried vegetable powders offer a long shelf life, making them an attractive option for busy households and food service providers. The ability to store these powders without refrigeration allows for easy incorporation into various dishes, from soups to smoothies. As the trend towards quick meal solutions continues, the market for freeze-dried vegetable powders is likely to expand. In 2023, the market was valued at approximately 1.5 billion USD, indicating a growing consumer preference for convenient food options that do not compromise on health.

Increased Use in Food Processing

The application of freeze-dried vegetable powders in food processing is a significant driver for the Freeze-dried Vegetable Powder Market. These powders are utilized in a variety of products, including snacks, ready-to-eat meals, and health supplements. The versatility of freeze-dried powders allows manufacturers to enhance flavor and nutritional content without adding bulk or moisture. As the food processing sector continues to innovate, the demand for freeze-dried vegetable powders is anticipated to rise. In 2023, the food processing industry accounted for over 60% of the total market share for freeze-dried products, underscoring the importance of these ingredients in modern food formulations.

Rising Demand for Natural Ingredients

There is a notable shift towards natural and organic ingredients in the food industry, which significantly influences the Freeze-dried Vegetable Powder Market. Consumers are increasingly aware of the health implications of artificial additives and preservatives, leading to a preference for products that are perceived as clean and wholesome. Freeze-dried vegetable powders, being minimally processed, align well with this trend. The market for organic freeze-dried products has seen a compound annual growth rate of around 8% in recent years, reflecting the increasing consumer inclination towards natural food sources. This trend is expected to continue, as more consumers seek transparency in food sourcing and production.

Growth of E-commerce and Online Retail

The expansion of e-commerce platforms is reshaping the retail landscape for the Freeze-dried Vegetable Powder Market. Consumers are increasingly turning to online shopping for convenience and variety, which has led to a surge in the availability of freeze-dried vegetable powders. E-commerce allows consumers to access a broader range of products, including niche and specialty items that may not be available in traditional retail outlets. This shift is particularly evident among health-conscious consumers who prefer to explore diverse options from the comfort of their homes. As of 2023, online sales of freeze-dried products have grown by approximately 25%, indicating a robust trend towards digital purchasing in the food sector.