Growing Demand for Scalability

The telecom cloud market in France experiences a notable surge in demand for scalable solutions. As businesses increasingly seek to adapt to fluctuating market conditions, the ability to scale resources up or down becomes essential. This trend is particularly evident among small and medium-sized enterprises (SMEs) that require flexible infrastructure to support their growth. According to recent data, approximately 65% of French companies prioritize scalability in their cloud solutions. This growing demand drives telecom providers to innovate and offer more adaptable services, thereby enhancing their competitive edge in the telecom cloud market. Furthermore, the shift towards remote work and digital transformation initiatives further amplifies the need for scalable cloud solutions, positioning telecom companies to capitalize on this trend.

Increased Focus on Cost Efficiency

Cost efficiency remains a pivotal driver in the telecom cloud market in France. Businesses are increasingly seeking cloud solutions that not only enhance operational efficiency but also reduce overall IT expenditures. Recent studies indicate that around 55% of French enterprises prioritize cost-effective cloud services as a key factor in their decision-making process. This trend compels telecom providers to develop competitive pricing models and value-added services that appeal to cost-conscious customers. By leveraging economies of scale and optimizing resource allocation, telecom companies can offer more attractive pricing structures, thereby enhancing their market share in the telecom cloud market. This focus on cost efficiency is likely to continue shaping the competitive landscape.

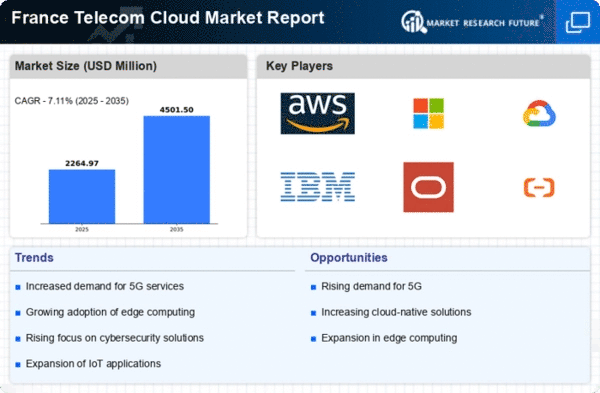

Advancements in Network Infrastructure

The telecom cloud market in France is poised for growth due to advancements in network infrastructure, particularly with the rollout of 5G technology. The deployment of 5G networks enhances connectivity and enables faster data transfer, which is crucial for cloud-based applications. As of November 2025, it is estimated that 40% of the French population has access to 5G services, facilitating the adoption of cloud solutions that require high bandwidth and low latency. This technological evolution encourages telecom providers to innovate their offerings, ensuring that they can support the increasing demand for high-performance cloud services. The integration of 5G capabilities into telecom cloud solutions is likely to attract more businesses, thereby expanding the market.

Regulatory Compliance and Data Sovereignty

In France, the telecom cloud market is significantly influenced by stringent regulatory requirements and the emphasis on data sovereignty. The French government mandates that data pertaining to its citizens must be stored within national borders, compelling telecom providers to ensure compliance with local laws. This regulatory landscape creates opportunities for telecom companies to develop tailored cloud solutions that meet these legal standards. Approximately 70% of enterprises in France express concerns regarding data privacy and compliance, which drives them to seek telecom cloud services that guarantee adherence to regulations. Consequently, telecom providers are investing in infrastructure and partnerships that enhance their ability to offer compliant solutions, thereby strengthening their position in the telecom cloud market.

Rising Demand for Enhanced Collaboration Tools

The telecom cloud market is witnessing a rising demand for enhanced collaboration tools, driven by the need for improved communication and teamwork among remote and hybrid workforces. As organizations adapt to new working models, the integration of cloud-based collaboration solutions becomes increasingly vital. Approximately 60% of French businesses report that they are investing in cloud collaboration tools to facilitate seamless communication among employees. This trend presents telecom providers with opportunities to develop and offer innovative collaboration solutions that cater to the evolving needs of their clients. By focusing on enhancing collaboration capabilities, telecom companies can strengthen their position in the telecom cloud market and attract a broader customer base.