Advancements in 5G Technology

The rollout of 5G technology is significantly influencing the telecom cloud market. With its promise of ultra-fast data speeds and low latency, 5G is enabling new applications and services that require robust cloud infrastructure. Telecommunications companies are investing heavily in cloud solutions to support the increased data traffic and connectivity demands associated with 5G. It is estimated that by 2025, 5G networks will account for over 50% of mobile subscriptions in the US, further driving the need for advanced cloud capabilities. This shift is likely to reshape the telecom cloud market, as providers adapt their offerings to leverage the benefits of 5G.

Growing Demand for Scalability

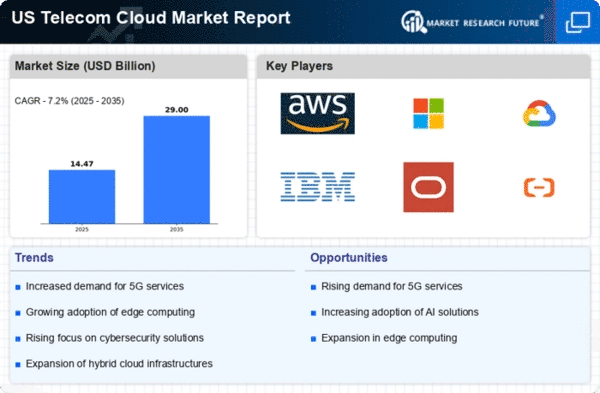

The telecom cloud market is experiencing a notable surge in demand for scalable solutions. As businesses increasingly seek to adapt to fluctuating workloads, the ability to scale resources up or down becomes essential. This trend is particularly pronounced in the telecommunications sector, where service providers must manage varying customer demands efficiently.. According to recent data, the US telecom cloud market is projected to grow at a CAGR of approximately 25% through 2026.. This growth is driven by the need for flexibility and the ability to deploy services rapidly, which are critical for maintaining competitive advantage in the telecom cloud market.

Increased Focus on Cost Efficiency

Cost efficiency remains a pivotal driver in the telecom cloud market. As competition intensifies, telecom operators are under pressure to reduce operational costs while enhancing service quality. Cloud solutions offer a pathway to achieve these objectives by minimizing the need for extensive physical infrastructure and enabling more efficient resource allocation. Reports indicate that companies adopting cloud technologies can reduce their IT costs by up to 30%. This financial incentive is compelling for many service providers, prompting a shift towards cloud-based models that promise both savings and improved service delivery in the telecom cloud market.

Regulatory Compliance and Data Sovereignty

Regulatory compliance is becoming increasingly critical in the telecom cloud market. With the rise of data protection laws, such as the California Consumer Privacy Act (CCPA), telecom operators must ensure that their cloud solutions adhere to stringent regulations. This compliance not only protects consumer data but also enhances trust in telecom services. As a result, many providers are investing in cloud infrastructures that prioritize data sovereignty, ensuring that data is stored and processed within specific jurisdictions. This trend is likely to shape the future landscape of the telecom cloud market, as companies navigate the complexities of regulatory requirements.

Emergence of AI and Automation Technologies

The integration of artificial intelligence (AI) and automation technologies is transforming the telecom cloud market. These innovations enable telecom operators to optimize network management, enhance customer experiences, and streamline operations. AI-driven analytics can provide insights into network performance, allowing for proactive maintenance and improved service delivery. Furthermore, automation reduces the need for manual intervention, leading to faster response times and increased efficiency. As AI technologies continue to evolve, their adoption in the telecom cloud market is expected to accelerate, potentially reshaping operational paradigms and service offerings.