Government Initiatives and Funding

Government initiatives aimed at improving healthcare access and quality are playing a crucial role in the physical therapy-equipment market in France. Recent policies have focused on increasing funding for rehabilitation services, which directly impacts the availability of physical therapy equipment. In 2025, it is anticipated that public funding for physical therapy will increase by 15%, allowing healthcare facilities to invest in advanced equipment. This financial support not only enhances the quality of care but also encourages innovation within the market. Manufacturers are likely to respond by developing new technologies that align with government health objectives, thereby fostering a more robust physical therapy-equipment market.

Integration of Digital Health Solutions

The integration of digital health solutions into the physical therapy-equipment market is transforming the landscape of rehabilitation in France. Telehealth services and mobile applications are becoming increasingly prevalent, allowing patients to access therapy remotely. This shift not only enhances patient engagement but also broadens the reach of physical therapy services. In 2025, it is estimated that around 30% of physical therapy sessions may occur through digital platforms, indicating a significant shift in service delivery. Consequently, equipment manufacturers are adapting their products to be compatible with these digital solutions, thereby enhancing the overall effectiveness of physical therapy interventions.

Increased Focus on Preventive Healthcare

There is a growing emphasis on preventive healthcare within the physical therapy-equipment market in France. As healthcare costs continue to rise, both patients and providers are recognizing the value of preventive measures to avoid more serious health issues. This trend is likely to drive the demand for physical therapy equipment that supports preventive care, such as balance training devices and ergonomic assessment tools. In 2025, the market for preventive physical therapy equipment is expected to expand by 10%, reflecting a shift in focus from reactive to proactive healthcare strategies. This change may lead to increased collaboration between physical therapists and other healthcare professionals, further enhancing the market's growth.

Rising Demand for Rehabilitation Services

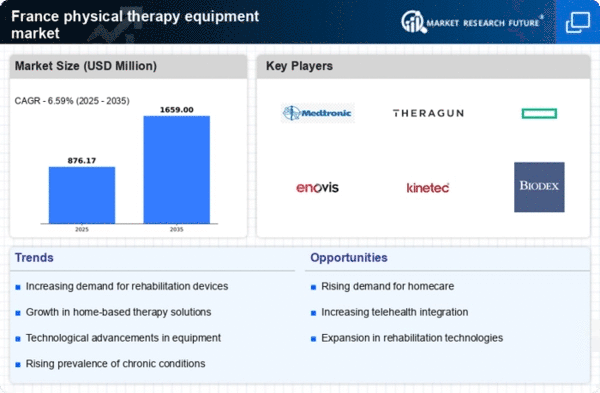

The physical therapy-equipment market in France is experiencing a notable increase in demand for rehabilitation services. This trend is largely driven by a growing awareness of the importance of physical therapy in recovery processes. As the population becomes more health-conscious, the need for effective rehabilitation solutions rises. In 2025, the market is projected to grow by approximately 8% annually, reflecting the increasing investment in healthcare infrastructure. Hospitals and clinics are expanding their physical therapy departments, necessitating advanced equipment to meet patient needs. This surge in demand is likely to stimulate innovation within the physical therapy-equipment market, as manufacturers strive to develop more effective and user-friendly devices.

Growing Awareness of Mental Health Benefits

The recognition of the mental health benefits associated with physical therapy is emerging as a significant driver in the physical therapy-equipment market in France. As mental health awareness increases, more individuals are seeking physical therapy not only for physical ailments but also for psychological well-being. This trend is likely to expand the market for equipment designed to support holistic therapy approaches, such as mindfulness and relaxation tools. In 2025, it is projected that the segment of the market focusing on mental health-related physical therapy will grow by approximately 12%. This shift may encourage practitioners to incorporate a wider range of therapeutic modalities, thereby enriching the overall landscape of the physical therapy-equipment market.