Aging Population

The aging population in South Korea is a crucial driver for the physical therapy-equipment market. As the demographic shifts towards an older age group, the demand for rehabilitation and physical therapy services increases. Older adults often experience mobility issues, chronic pain, and other health conditions that necessitate physical therapy interventions. According to recent statistics, approximately 15% of the South Korean population is aged 65 and older, a figure projected to rise significantly in the coming years. This demographic trend is likely to spur investments in physical therapy equipment, as healthcare providers seek to enhance their service offerings to cater to the needs of elderly patients. Consequently, the physical therapy-equipment market is expected to expand as facilities upgrade their equipment to provide effective rehabilitation solutions for this growing segment.

Technological Integration

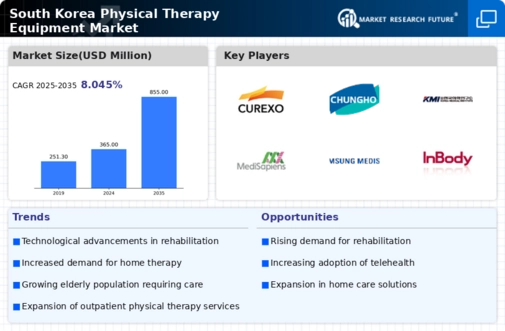

The integration of advanced technologies into the physical therapy market is transforming treatment methodologies in South Korea. Innovations such as telehealth platforms, wearable devices, and smart rehabilitation equipment are becoming increasingly prevalent. These technologies facilitate remote monitoring and personalized treatment plans, enhancing patient engagement and outcomes. For instance, the use of virtual reality in rehabilitation has shown promising results in improving patient motivation and recovery rates. The market for smart rehabilitation devices is projected to grow at a CAGR of around 10% over the next five years, indicating a robust demand for technologically advanced equipment. As healthcare providers adopt these innovations, the physical therapy-equipment market is likely to witness significant growth, driven by the need for more effective and efficient treatment options.

Increased Health Expenditure

In South Korea, the increase in health expenditure is a notable driver for the physical therapy-equipment market. The government and private sectors are investing more in healthcare services, including rehabilitation and physical therapy. Recent data indicates that health expenditure as a share of GDP has risen to approximately 8%, reflecting a growing commitment to improving healthcare infrastructure. This increase in funding allows healthcare facilities to acquire advanced physical therapy equipment, enhancing the quality of care provided to patients. As hospitals and clinics expand their services to meet the rising demand for rehabilitation, the physical therapy-equipment market is likely to experience substantial growth. The trend suggests a positive outlook for manufacturers and suppliers of physical therapy equipment in the region.

Rising Incidence of Chronic Diseases

The rising incidence of chronic diseases in South Korea is a significant driver for the physical therapy-equipment market. Conditions such as diabetes, obesity, and cardiovascular diseases are becoming increasingly prevalent, leading to a higher demand for rehabilitation services. According to health reports, nearly 30% of the adult population in South Korea is classified as obese, which is associated with various health complications requiring physical therapy. This trend necessitates the use of specialized equipment designed for rehabilitation and recovery. As healthcare systems focus on managing chronic conditions through physical therapy, the market for related equipment is expected to grow. The physical therapy market is thus positioned to benefit from the increasing need for effective treatment solutions tailored to chronic disease management.

Growing Awareness of Preventive Healthcare

The growing awareness of preventive healthcare among the South Korean population is driving the physical therapy-equipment market. As individuals become more conscious of the importance of maintaining physical health and preventing injuries, there is an increasing demand for physical therapy services. Educational campaigns and health initiatives have contributed to this shift in mindset, encouraging people to seek therapy not only for rehabilitation but also for preventive measures. This trend is reflected in the rising number of fitness centers and wellness programs that incorporate physical therapy services. Consequently, the physical therapy-equipment market is likely to benefit from this heightened awareness, as facilities invest in equipment that supports both rehabilitation and preventive care. The market is expected to expand as more individuals prioritize their health and seek professional guidance.