Growth of E-commerce Platforms

The the natural cheese market is witnessing a transformation due to the rise of e-commerce platforms. In 2025, online sales of cheese are expected to grow by approximately 20%, reflecting a shift in consumer purchasing behavior. The convenience of online shopping, coupled with the ability to access a wider variety of products, is driving this trend. E-commerce platforms allow consumers to explore artisanal and specialty cheeses that may not be available in local stores. This expansion of distribution channels is particularly beneficial for small-scale producers in the natural cheese market, enabling them to reach a broader audience. As online shopping continues to gain traction, it is likely to play a crucial role in shaping the future landscape of the natural cheese market in France.

Increased Focus on Local Sourcing

The the natural cheese market is significantly influenced by the trend of local sourcing. Consumers are increasingly inclined to support local producers, which fosters a sense of community and trust in food quality. In 2025, it is estimated that locally sourced cheese will represent around 30% of the natural cheese market. This preference for local products is often associated with perceptions of freshness and superior taste. Additionally, local sourcing reduces transportation emissions, appealing to environmentally conscious consumers. As a result, many cheese makers are emphasizing their regional heritage and traditional production methods, which not only enhances their brand identity but also strengthens their position in the competitive landscape of the natural cheese market.

Innovations in Packaging Solutions

The the natural cheese market is experiencing a wave of innovations in packaging solutions. As sustainability becomes a priority, manufacturers are exploring eco-friendly packaging options that reduce environmental impact. In 2025, it is anticipated that sustainable packaging will account for about 25% of the total packaging used in the natural cheese market. This shift not only addresses consumer concerns regarding waste but also enhances product shelf life and freshness. Innovative packaging solutions, such as biodegradable materials and resealable designs, are gaining traction among consumers who value convenience and sustainability. By adopting these new packaging technologies, producers can differentiate their products in a crowded market, potentially leading to increased sales and customer loyalty in the natural cheese market.

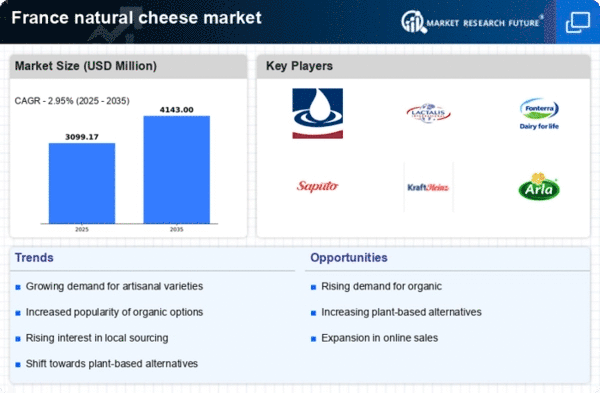

Rising Demand for Organic Products

The the natural cheese market experiences a notable increase in demand for organic products. Consumers are increasingly prioritizing health and sustainability, leading to a shift towards organic cheese options. In 2025, organic cheese sales are projected to account for approximately 15% of the total cheese market in France. This trend is driven by a growing awareness of the benefits of organic farming practices, which are perceived to yield higher quality and safer products. As a result, producers in the natural cheese market are adapting their offerings to include organic varieties, thereby catering to this evolving consumer preference. The emphasis on organic products not only enhances the market's appeal but also aligns with broader environmental goals, potentially boosting the overall growth of the natural cheese market in France.

Culinary Trends and Pairing Opportunities

The the natural cheese market is significantly shaped by evolving culinary trends and pairing opportunities. As consumers become more adventurous in their food choices, there is a growing interest in pairing natural cheeses with various foods and beverages. In 2025, it is estimated that cheese pairing events and workshops will increase by 30%, reflecting a heightened consumer engagement with cheese. This trend encourages consumers to explore diverse flavor profiles and enhances their overall dining experience. Additionally, the rise of gourmet food culture in France has led to an increased appreciation for artisanal cheeses, which are often featured in high-end culinary settings. By capitalizing on these culinary trends, producers in the natural cheese market can create unique offerings that resonate with consumers seeking novel gastronomic experiences.