Rising Security Concerns

The mobile biometric-security-service market in France is experiencing growth due to escalating security concerns among consumers and businesses. With increasing incidents of identity theft and cybercrime, there is a heightened demand for secure authentication methods. According to recent data, approximately 70% of French consumers express anxiety regarding online security, prompting organizations to adopt biometric solutions. This trend is particularly evident in sectors such as banking and e-commerce, where secure transactions are paramount. The mobile biometric-security-service market is thus positioned to address these concerns. It offers solutions that enhance user trust and protect sensitive information. As security threats evolve, the market is likely to expand further, driven by the need for robust security measures.

Technological Advancements

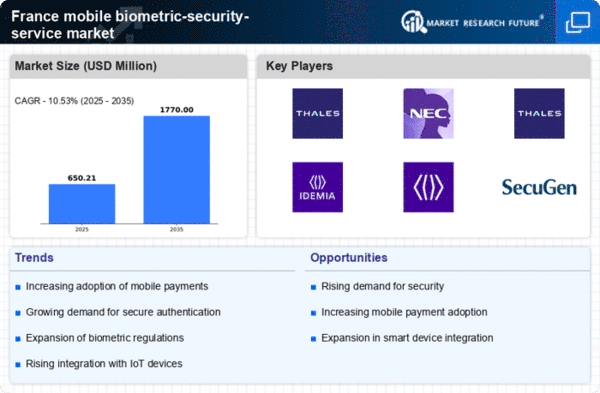

Technological advancements play a pivotal role in shaping the mobile biometric-security-service market in France. Innovations in biometric technologies, such as facial recognition and fingerprint scanning, have made these solutions more accessible and efficient. The integration of artificial intelligence (AI) and machine learning enhances the accuracy and speed of biometric authentication processes. In 2025, the market is projected to reach a valuation of €1.5 billion, reflecting a compound annual growth rate (CAGR) of 15%. These advancements not only improve user experience but also reduce the likelihood of fraud, making biometric solutions increasingly attractive to businesses. As technology continues to evolve, the mobile biometric-security-service market is expected to witness further growth, driven by the demand for cutting-edge security solutions.

Consumer Demand for Convenience

Consumer demand for convenience is a key driver of the mobile biometric-security-service market in France. As lifestyles become increasingly fast-paced, individuals seek seamless and efficient authentication methods. Biometric solutions, such as facial recognition and voice authentication, offer a user-friendly alternative to traditional passwords. In 2025, it is estimated that over 60% of French consumers will prefer biometric authentication for online transactions. This shift in consumer behavior is prompting businesses to adopt biometric technologies to enhance customer experience and streamline operations. The mobile biometric-security-service market is thus likely to benefit from this trend, as organizations strive to meet the evolving expectations of their customers.

Increased Investment in Cybersecurity

Increased investment in cybersecurity is driving the mobile biometric-security-service market in France. Organizations are recognizing the importance of robust security measures to protect sensitive data and maintain customer trust. In 2025, it is projected that French companies will allocate approximately €3 billion towards cybersecurity initiatives, with a significant portion directed towards biometric solutions. This investment reflects a growing awareness of the risks associated with cyber threats and the need for advanced security technologies. As businesses prioritize cybersecurity, The mobile biometric-security-service market is expected to flourish. It will provide innovative solutions that address the challenges of identity verification and fraud prevention.

Government Initiatives and Regulations

Government initiatives and regulations are significantly influencing the mobile biometric-security-service market in France. The French government has been proactive in promoting the adoption of biometric technologies to enhance national security and streamline public services. Recent policies encourage the integration of biometric systems in various sectors, including healthcare and law enforcement. This regulatory support is likely to foster a conducive environment for market growth, as businesses seek to comply with new standards. Furthermore, the European Union's General Data Protection Regulation (GDPR) emphasizes the importance of data protection, which aligns with the secure nature of biometric solutions. As a result, the mobile biometric-security-service market is poised for expansion, driven by favorable government policies and regulatory frameworks.