Growing Healthcare Expenditure

The rising healthcare expenditure in France is a significant driver for the hip implants market. With the French government allocating approximately €200 billion annually to healthcare, there is a concerted effort to improve surgical services and patient care. This financial commitment facilitates access to advanced medical technologies, including hip implants. The hip implants market benefits from this increased funding, as hospitals are more likely to invest in high-quality implants and innovative surgical solutions. Additionally, the trend towards value-based care encourages healthcare providers to adopt effective treatments that enhance patient outcomes, further stimulating market growth. As a result, the hip implants market is poised for expansion, supported by a robust healthcare infrastructure.

Increased Awareness and Education

There is a growing awareness and education regarding hip health among the French population, which is positively impacting the hip implants market. Public health campaigns and educational programs are informing individuals about the importance of early diagnosis and treatment of hip disorders. This heightened awareness is leading to an increase in consultations with orthopedic specialists, resulting in more patients seeking surgical options. The hip implants market is likely to benefit from this trend, as more individuals become proactive about their health. Furthermore, as patients become better informed about the benefits of hip implants, the demand for these products is expected to rise. This shift in patient behavior could potentially lead to a market growth rate of 5% over the next few years.

Rising Incidence of Hip Disorders

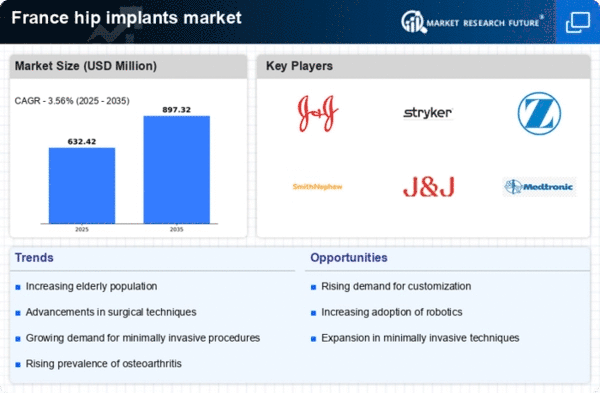

The increasing prevalence of hip disorders in France is a primary driver for the hip implants market. Conditions such as osteoarthritis and hip fractures are becoming more common, particularly among the elderly population. According to recent health statistics, approximately 15% of adults aged 60 and above in France experience significant hip-related issues. This trend is likely to escalate as the population ages, leading to a higher demand for hip implants. The hip implants market is responding to this need by innovating and expanding product offerings to cater to a growing patient base. Furthermore, the economic burden associated with untreated hip disorders, estimated at €2 billion annually in healthcare costs, underscores the necessity for effective surgical interventions, thereby propelling the market forward.

Advancements in Surgical Techniques

Innovations in surgical techniques are significantly influencing the hip implants market. Minimally invasive procedures, such as direct anterior approach hip replacement, are gaining traction in France, offering patients reduced recovery times and improved outcomes. These advancements not only enhance patient satisfaction but also increase the efficiency of surgical operations. The hip implants market is witnessing a shift towards these modern techniques, which are supported by ongoing training and education for orthopedic surgeons. As hospitals adopt these advanced methods, the demand for high-quality implants is expected to rise. This trend is reflected in the market, with a projected growth rate of 6% annually over the next five years, driven by the increasing preference for less invasive surgical options.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is driving the hip implants market in France. Innovations such as 3D printing and computer-assisted surgery are revolutionizing the way hip implants are designed and implanted. These technologies allow for personalized implants that fit patients more accurately, improving surgical outcomes and patient satisfaction. The hip implants market is adapting to these technological advancements, with manufacturers investing in research and development to create cutting-edge products. As hospitals increasingly adopt these technologies, the demand for sophisticated hip implants is expected to grow. This trend indicates a potential market expansion, with projections suggesting a compound annual growth rate of 7% over the next five years, as the industry embraces the future of orthopedic surgery.