Government Initiatives and Funding

Government initiatives in France are playing a pivotal role in fostering the high performance-computing-as-a-service market. The French government has allocated substantial funding to support research and development in high-performance computing technologies. This includes investments in national supercomputing centers and partnerships with private enterprises to enhance computational capabilities. Such initiatives not only stimulate innovation but also encourage businesses to adopt high performance-computing-as-a-service solutions. The commitment to advancing digital infrastructure is evident, with the government aiming to position France as a leader in the European digital economy. This supportive environment is likely to drive market growth, as organizations capitalize on available resources and funding opportunities.

Shift Towards Remote Work and Collaboration

The shift towards remote work and collaboration has significantly influenced the high performance-computing-as-a-service market in France. As organizations adapt to new work environments, the demand for accessible and powerful computing resources has intensified. High performance-computing-as-a-service solutions offer flexibility and scalability, enabling teams to collaborate effectively regardless of their physical location. This trend is particularly relevant in sectors such as academia and research, where collaborative projects often require substantial computational power. The market is projected to grow as more organizations recognize the benefits of cloud-based high performance computing, facilitating seamless access to resources and enhancing productivity.

Emergence of Advanced Analytics and Simulation

The emergence of advanced analytics and simulation technologies is driving the high performance-computing-as-a-service market in France. Industries are increasingly utilizing sophisticated modeling and simulation tools to gain insights and make informed decisions. This trend is particularly pronounced in sectors such as automotive, aerospace, and pharmaceuticals, where complex simulations are essential for product development and testing. The high performance-computing-as-a-service market is expected to benefit from this growing need, as organizations seek to leverage powerful computing resources to enhance their analytical capabilities. The integration of these technologies is likely to propel market growth, as businesses strive for innovation and efficiency.

Growing Demand for Data-Intensive Applications

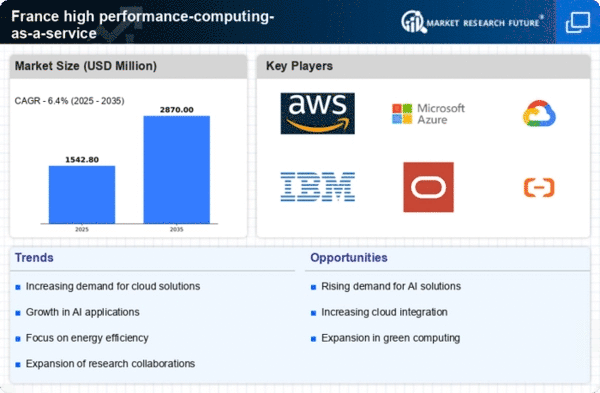

The high performance-computing-as-a-service market in France is experiencing a surge in demand driven by the increasing reliance on data-intensive applications across various sectors. Industries such as finance, healthcare, and research are leveraging advanced computing capabilities to process vast amounts of data efficiently. This trend is reflected in the projected growth of the market, which is expected to reach approximately €1.5 billion by 2026. Organizations are seeking scalable solutions that can handle complex computations, thereby propelling the adoption of high performance-computing-as-a-service offerings. As businesses strive to enhance their analytical capabilities, the need for robust computing resources becomes paramount, indicating a strong trajectory for the market in the coming years.

Rising Importance of Cybersecurity in Computing Services

As the high performance-computing-as-a-service market expands in France, the importance of cybersecurity is becoming increasingly evident. Organizations are recognizing the need to protect sensitive data and computational resources from cyber threats. This has led to a heightened focus on integrating robust security measures within high performance computing services. The market is likely to see a rise in demand for solutions that not only provide computational power but also ensure data integrity and security. As businesses prioritize cybersecurity, the high performance-computing-as-a-service market is expected to evolve, offering enhanced security features to meet the growing concerns of organizations.